Solari North American Video Server

“Come, Watson, come!…The game is afoot.” ~ Sir Arthur Conan Doyle, The Return of Sherlock Holmes

By Catherine Austin Fitts

This coming week – the first week of a new year – we will begin our publication of the 2017 Annual Wrap Up.

For the first two weeks, Dr. Joseph P. Farrell will join me to discuss News Trends & Stories. In Part I, we look at the 10 top stories of 2017 in Economy & Financial Markets and Geopolitics:

1. 2017: The Year of Punching Back

2. Global 2.0 to 3.0: The Shift Starts Up the S Curve

3. Tsunami Of Ops

4. BRICS Build Independent Systems

5. The Trump Shock (including our 2017 Trump Administration report card)

6. US Budget: The US Doubles Down on Missing Money, War & Arms Sales

7. Planet Equity, Crash Up & the Bull Market in Centralization

8. The European Union After Brexit

9. Pension Fund Crisis

10. Dawning Realization: Time to Enforce

As you listen, check out our web presentation for News Trends & Stories including our complete trends list, our choices for top news videos of the year, and our description of each of the 10 top stories.

In the week following we will cover the 10 top stories in Culture and Science, Space & Technology and discuss UnAnswered Questions, Inspiration and Go Local.

Because our “in person, in depth” discussions in the 2017 3rd Quarter Wrap Up were popular, Dr. Farrell and I used the same format again for our discussion of News Trends & Stories for the 2017 Annual Wrap Up. Inasmuch as our discussion is lengthy, we will publish both full-length and chapter-length versions so you can listen selectively if you prefer. These discussions explore 2017 to find the most important developments that will inform the year ahead. This in-depth discussion has been immensely productive for both Dr. Farrell and myself.

In our third week I will cover equity markets and publish the first Blockbuster Chartology from Rambus for the new year, 2018.

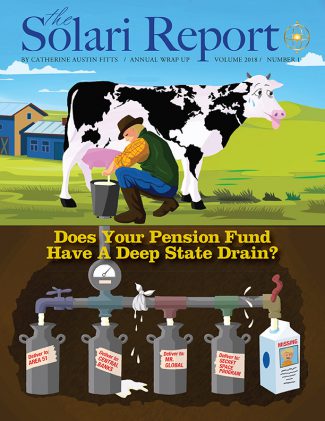

In the final week we will address our 2017 Annual Wrap Up theme: Does Your Pension Fund Have a Deep State Drain? Money is going missing in many directions. It’s time to ask some serious questions about whether and how this is impacting our pension funds. In the United States and many countries, taxpayers are on the hook for corporate and government pension funds. Whether you have a pension fund or not, this will impact your finances and the finances of your neighbors and community too.

In Money & Markets this week I will discuss the latest in financial and geopolitical news.

In Let’s Go to the Movies, I will review Wormwood, Chapters 1-6 and what its publication by Netflix says about the Washington press corp, including the Washington Post.

Please post or e-mail your questions for Ask Catherine.

Talk to you Thursday!

Film trailer – So it looks like Netflax wants to cash in on the “alternative” audience…

Happy New Year!

Yup. A good development. They have algorithms that drive them to what people want.

Happy New Year to ALL Solarians!!

Gotta say something about ‘The Weather’. NOW there is a winter hurricane hammering the East Coast from Florida to Canada. Last month So California had our HUGE fire AND a 20 day Santa Ana Wind event (usual is 4 days MAX). Then the No Cal fires in the Fall. Then Houston get 51 inches of rain in a day or two! Then the Florida hurricane. Back to back to back to back.

Seriously there IS something wrong here. What’s / where’s next? (Just had a small quake in San Francisco, btw ….)

All seem somewhat ‘reasonable’ for those still sleeping. But when you know about HAARP and disaster capitalism – I am a true believer now. What ARE these people up to, anyway ….. ???

PS Can’t wait for this month’s Solari Reports, Catherine! Thank you in advance ….. 🙂

Happy New Year to ALL Solarians!!

Gotta say something about ‘The Weather’. NOW there is a winter hurricane hammering the East Coast from Florida to Canada. Last month So California had our HUGE fire AND a 20 day Santa Ana Wind event (usual is 4 days MAX). Then the No Cal fires in the Fall. Then Houston get 51 inches of rain in a day or two! Then the Florida hurricane. Back to back to back to back.

Seriously there IS something wrong here. What’s / where’s next? (Just had a small quake in San Francisco, btw ….)

All seem somewhat ‘reasonable’ for those still sleeping. But when you know about HAARP and disaster capitalism – I am a true believer now. What ARE these people up to, anyway ….. ???

PS Can’t wait for this month’s Solari Reports, Catherine! Thank you in advance ….. 🙂

Yes. Extreme weather and disaster capitalism are much greater risks for most of us than financial collapse or stock market crash.

Yes. Extreme weather and disaster capitalism are much greater risks for most of us than financial collapse or stock market crash.

JUST finished this week’s epic interview / review. Whew! What a grand slam home run! Thank you for the immense about of amazing material you included! Given my usual multiple listens to every Solari audio, I’ve got my homework cut out for me in the weeks ahead. 🙂

As for grading President Trump, I give him much higher marks than either you or Joseph (both I HIGHLY respect). My caveat is that Trump has very limited authority over a small amount of the government and our policies. Given his Art of the Deal approach to getting things done, I can imagine a scenario where he ‘gave up’ some ground to the military and foreign policy so that he could gain ground nationally. Example, the ‘strike’ on the air base last Spring seemed to be more ceremonial than anything.

He did get us out of the TPP, the Paris Climate deal, tax cuts (‘Yuge’ positive impact) and his most recent Executive Order against the assets of those committing crimes against the people. Most of all, I give him a high ‘A’ for staying alive during his first year. After all, the last two people who thought they were actually the president of our country (Kennedy & Reagan) were shot.

It seems like so many people discount the huge head winds that Trump faces every day and from every other aspect of government, the media and so many rabid anti-Trumpers. The fact that he has done as well as he has – all in his first year – is simply amazing. He seems to have us pointed us in a new and better direction and to have done real and lasting damage to the pro-Centralization Team.

Would love to know your thoughts on this one, Catherine. I don’t know much about the Israel connections nor about Trump’s more hidden deep state connections. I remain open to your wisdom and insights ….

Yes, good points. His accomplishments have been significant – and represent an enormous turn. He does very well on the things he can unilaterally decide. When it comes to things that require team work – there is an inability to get create that teamwork/leadership yet. And you are right – he does deserve an A for staying alive and not quitting. Given the beating he has taken that is quite an accomplishment.

I don’t know how to assess the new EO – have to see how it is used. The announcement that the FBI is investigating the Clintons is very good news – so there may be a lot going on behind the scenes that can turn into an A+ performance. The purges are clearly underway. If they are well done, it will be an enormous accomplishment. If there is a hint of lawlessness to them, not so good. So we will have to see. I am encouraged by the people he has chosen who will be responsible to make sure these go according to the law.

Appreciate your comments. Essentially to understand that we can not depend on federal government to get back the $21 Trillion – we have to act with state and local officials and courts to do that. More soon from Solari Report exploring how to do that.

JUST finished this week’s epic interview / review. Whew! What a grand slam home run! Thank you for the immense about of amazing material you included! Given my usual multiple listens to every Solari audio, I’ve got my homework cut out for me in the weeks ahead. 🙂

As for grading President Trump, I give him much higher marks than either you or Joseph (both I HIGHLY respect). My caveat is that Trump has very limited authority over a small amount of the government and our policies. Given his Art of the Deal approach to getting things done, I can imagine a scenario where he ‘gave up’ some ground to the military and foreign policy so that he could gain ground nationally. Example, the ‘strike’ on the air base last Spring seemed to be more ceremonial than anything.

He did get us out of the TPP, the Paris Climate deal, tax cuts (‘Yuge’ positive impact) and his most recent Executive Order against the assets of those committing crimes against the people. Most of all, I give him a high ‘A’ for staying alive during his first year. After all, the last two people who thought they were actually the president of our country (Kennedy & Reagan) were shot.

It seems like so many people discount the huge head winds that Trump faces every day and from every other aspect of government, the media and so many rabid anti-Trumpers. The fact that he has done as well as he has – all in his first year – is simply amazing. He seems to have us pointed us in a new and better direction and to have done real and lasting damage to the pro-Centralization Team.

Would love to know your thoughts on this one, Catherine. I don’t know much about the Israel connections nor about Trump’s more hidden deep state connections. I remain open to your wisdom and insights ….

Yes, good points. His accomplishments have been significant – and represent an enormous turn. He does very well on the things he can unilaterally decide. When it comes to things that require team work – there is an inability to get create that teamwork/leadership yet. And you are right – he does deserve an A for staying alive and not quitting. Given the beating he has taken that is quite an accomplishment.

I don’t know how to assess the new EO – have to see how it is used. The announcement that the FBI is investigating the Clintons is very good news – so there may be a lot going on behind the scenes that can turn into an A performance. The purges are clearly underway. If they are well done, it will be an enormous accomplishment. If there is a hint of lawlessness to them, not so good. So we will have to see. I am encouraged by the people he has chosen who will be responsible to make sure these go according to the law.

Appreciate your comments. Essentially to understand that we can not depend on federal government to get back the $21 Trillion – we have to act with state and local officials and courts to do that. More soon from Solari Report exploring how to do that.