By Catherine Austin Fitts

“Betting against gold is the same as betting on governments. He who bets on governments and government money bets against 6,000 years of recorded human history.”

~ Gary North

This week, we publish Franklin Sanders’ new collection on expanding gold and silver usage, and Franklin joins me to discuss gold and silver as a means of upholding individual and family sovereignty.

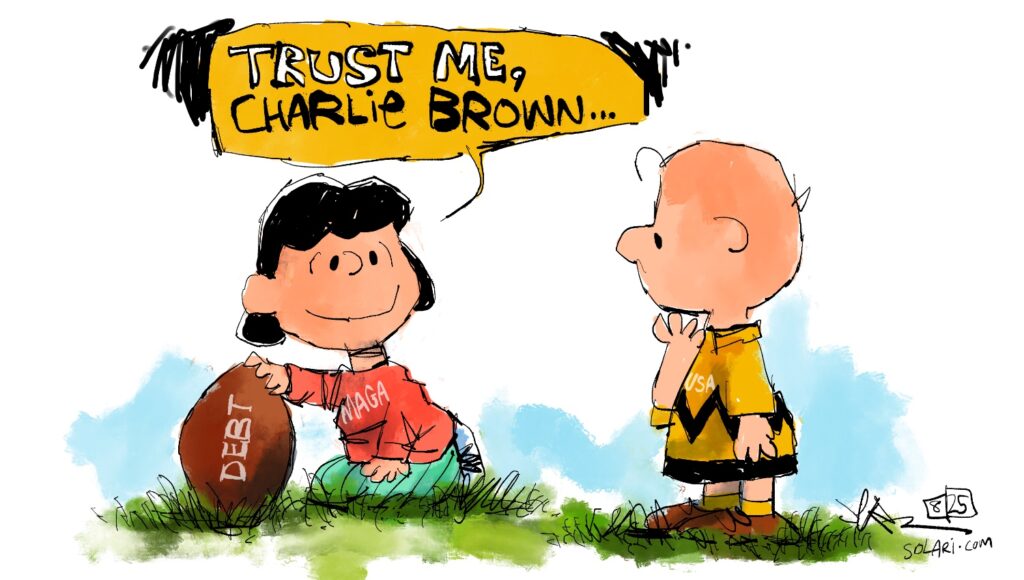

The launch of the Going Direct Reset set into motion what Franklin describes as a “monstrous and unendurable inflation”—never before seen in U.S. history. These and other events make it clear that we must break our addiction to federal spending and credit. In most U.S. states, 50% or more of the people take their living from federal government—either directly from the federal government or from federally subsidized state and local government spending. What happens if, as seems possible, the federal government reneges on its promises to the people or inflates them away?

The good news is that in the U.S. and other parts of the world, gold and silver usage (as well as use of cash and coin) are increasing and can help contribute to the infrastructure and conditions necessary for maintaining state and individual sovereignty. In many areas, there is no need to wait for the passage of new laws or the setting up of a new bureaucracy. For example, U.S. law already favors gold and silver. In the United States, it is perfectly legal to contract among ourselves to use gold and silver in our daily transactions with each other—the area of our lives where we have the most control and initiative.

That said, it is of the utmost importance that we insist that our state and local legislatures take steps to protect state and pension fund assets and support a stronger local financial infrastructure. Franklin’s presentation includes steps you can ask your state legislatures to take to improve the daily use of gold and silver.

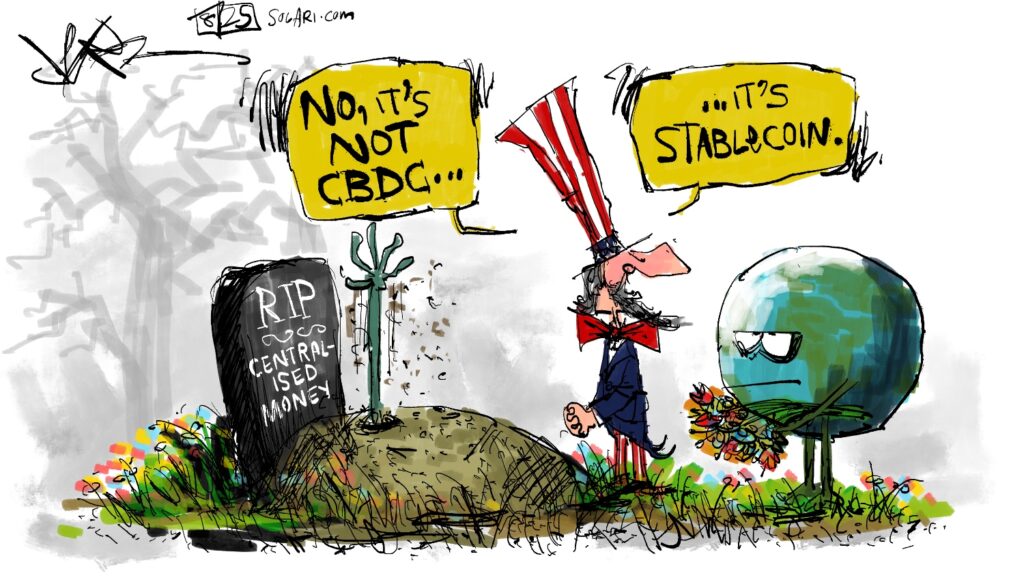

In an age of digital assets—and with the threat of a sovereignty-destroying central bank digital currency (CBDC) control grid on the horizon—Franklin also reminds us that gold and silver have the virtues of being analog financial assets as well as the assets with no counterparty risk.

Please check out Franklin’s full written discussion on the 2nd Quarter 2022 Wrap Up web presentation when it publishes next Thursday. Here is an overview outline:

I. Introduction

II. Beats Me! What Is a Dollar?

III. Terms and Presuppositions

IV. Why Silver?

V. Interview with Stefan Gleason, Sound Money Defense League, on Abolishing Sales Tax on Gold and Silver

VI. How to Barter with Gold and Silver Coins

VII. Where’s a Depository You Can Trust?

VIII. How Not to Lose Money on Silver and Gold

IX. Sovereign vs. Global: A Shopping List for Your State Legislators

X. Gold and Silver Clause Contracts: An Escape Route

We will also publish a new survey of trends in European taxation and regulation of gold and silver by French attorney Karine Solon. While many U.S. states are lowering the barriers to daily usage of gold and silver, the European Union remains a high-friction market.

It is never too hard or too late to build the future we want for ourselves and our families. With the goal of sovereignty foremost in all of our minds, join us for this discussion, both practical and inspiring, of how you can use gold and silver money in your daily life.

This is the last week of the month, so there is no Money & Markets or Ask Catherine. E-mail your questions for Ask Catherine or post at the Money & Markets commentary for the following week here.

Talk to you Thursday!

Related Solari Reports:

The Silver and Gold Payment Calculator with Franklin Sanders

Thank you, Catherine. Great interviews!

Loved this interview Catherine and Franklin.

I can watch ths, but like last weeks report with John Titus, I cannot download the video because it is only HLS Streaming, and not .mp4. I hope this is not a new feature. Financial Rebellion 32 downloads just fine.

On the list to switch to downloadable today.

We are concerned about bandwidth. Will switch it on this coming week and lets see how it works.

Catherine- excited for this report! A fellow subscriber and I met in another site we are both subscribed to! We connected over the Gold and Silver Calculator update and this new report!

We are both purposing to make a difference in our respective counties. Thanks to you and Franklin for giving us the tools! This calls to mind a paraphrase of what Jon Rappoport stated years ago on an interview with you- step out and declare what you are trying to do, people will hear you and some will step out with you and you all can work together to make it happen.

Sending our best wishes and prayers for continued success of your endeavors!

Catherine, I enjoyed this 2nd Qtr report and learned plenty. Not easy to digest but valuable I believe.As usual I passionately disagree when you infer and say that we should all forget about the Presidential elections when planning our financial future.

This is true in a sense but really ridiculous generalization. The president of US has vast power and influence and who holds this position is damn important.

Consider Trump versus Biden as Pres-what a difference for main street and the world!!!

I know you will scream and laugh-but I beg you to review this fron the The Last Refuge a few weeks ago. Sundance looks at Trump presidency in detail-considering his failures and victories. It would be worth you review. You are clearly brilliant -but so Sundance and so is Trump. God bless you for all you are doing to keep us free of tyranny. Here is link https://mail.google.com/mail/u/0/?hl=en#inbox/FMfcgzGpHHMVrHBhVPKrWPxMNWxNmNNz

I pray link works. If not you can find it at Last Refuge site under Trump and Musk have something in common.

Thanks, William. Will take a look.

I recently moved my IRA from Fidelity into a precious metals IRA. I used Volunteer Precious Metals and had the good fortune to have had Franklin himself answer the phone, and help me with this rather substantial buy. I was completely new to the process, and he took a lot of time answering my many questions. The whole process was a pleasure, and I can highly recommend VPM.

I would have to say that Southeast Texas is easily competitive with Tennessee for out of State transplants moving into the area , even with the Real Estate declining Nationaly my neighborhood has not seen any slow down of new home construction the concrete trucks start rolling in at 6 :30 a.m. followed by the semis loaded with lumber , plumbers , roofers etc. this 6 Day’s a week for the last 5 years and if anything it’s increasing in velocity , I have a front row seat due to being a long term retired resident .

I think the immigration into Texas is far from over.