![]() In our new audio seminar, Positioning Your Assets for Growth in Uncertain Times, among the many issues we address are one of the risks of holding your savings in a currency that is falling in value relative to other currencies and real things.

In our new audio seminar, Positioning Your Assets for Growth in Uncertain Times, among the many issues we address are one of the risks of holding your savings in a currency that is falling in value relative to other currencies and real things.

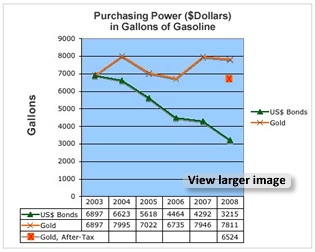

As an example, we show the cash flows of a 5% five-year corporate bond from 2003 to 2008. When the investor gets principal back in 2008, the dollar investment has dropped 50% in purchasing power when measured in the price of gallons of gas.

Now, let’s scale that up for an entire household. Let’s say we have a mother and a father, two children and an elderly grandmother living in the San Francisco Bay area. They have three checking accounts, with total balances of $5,250. The grandmother has two CDs at a local bank for an additional bank balance of $100,000 and the older child has a savings account of $75 from what she saved cutting yards during the summer and babysitting during the school year.

The couple has a 401k and an IRA. Among the assets held in these accounts are dollar- denominated money markets with another $20,175 as well as several dollar-denominated bond funds worth $70,000. They also share a brokerage account that has $30,000 in California municipal bonds and $23,000 in another money market account.

If you look at their collective wallets and the coin jar they have in the living room, they have another $500 in cash within the household. They also have reserves in some of their financing and vendor relations, including a $200 deposit with their utility company and an $800 balance on average in their mortgage reserve for taxes and insurance.

For simplicity’s sake, let’s say they have maintained these average balances from the beginning in 2003 to the beginning of 2008. That is, they have had $250,000 in dollar- denominated assets during this period that produce no or a modest income.

How much have they lost in purchasing power when we use gas as our currency instead of dollars?

They have lost approximately $250,000 of purchasing power in current dollar terms – a quarter of a million dollars!

That’s right. Whatever your average balances held in dollars are over the last five years, that is approximately how much you have lost in real purchasing power when we measure it in gallons of gas priced as of the beginning of the year. Of course, things are worse since then.

Does that help you understand why you are feeling drained?

This type of drain is part of a phenomenon we call the Slow Burn. We want to help you understand the Slow Burn and reverse the drain that a falling dollar is causing in your life. Remember – it is never too late to act!

Patricia:

Thank you! And remember…where two or more are gathered in my name…

Catherine

I so appreciated you on George Noory’s program last night. Keep up the good work and with His help you will.

I heard you on Coast to Coast last night and am now checking into your website. I think it would be wise for everyone to take stock of their entire investments and try to reposition. I am a Realtor in Tucson, have been a professional in this field for 19 yrs and by God’s mercy I have been very busy and fulfilled in my work. I note this fact because there are thousands of people who have a Realtor’s License but have precious little experience. I have a question for you–As I evaluate the plans that the government is suggesting regarding the home loan difficulties and I meet with real people with real difficulties, I have come up with something I believe the Government could do, however, I may be incapable of evaluating the potential long term problems this solution would bring about. I believe that the government should allow citizens to take a one time draw from their retirement to drop their monthly payment and to be able to do so without paying taxes so that the greatest possible benifit woudl be afforded the people paying down morgages: It would accomplish further commitment to the home, Less outgo each month for the owner and they would not be so concerned about their retirement dollars shrinking because they would nhot owe as much money, and could hopefully not be concerned about drawing down the principle on their investments.

I would suspect that this would pull a great many dollars out of the stockmarket,

It would strengthen banks because they would be receiving large sums of money and have lower debt to loan ratios……

Can this be considered? Who could I suggest it to? I contacted Senator McCain’s office and spoke to a very UNIMPRESSED YOUNG MAN who said it was to difficult because it would require a change in the tax code. Am I nieve to think it could be done with a bill that allowed up to a specific amount to be paid off without a tax penallty.

Please let me know if this is foolish.

Linda Nelson

Catherine,

I love your blog. I love everything you are doing for us little guys out here.

Thanks.

Linda:

It is a good idea. I would recommend that you write a letter to your two senators and congressman that is no longer then one page and then also post here. Yes, it would require an amendment to the tax code and that could take time. However, things will continue to deteriorate until we take the necessary steps to stop them.

Keep those ideas coming!

Catherine

Pearl:

Thanks so much for letting me know. I really appreciate it!

Best,

Catherine

catherine;

i heard you on coast to coast the other night. your understanding of the economic problems reflect my own thoughts. you gave me some new perspectives.

thanks again.