Listen to the MP3 audio file

The Solari Report – 12 Mar 2009

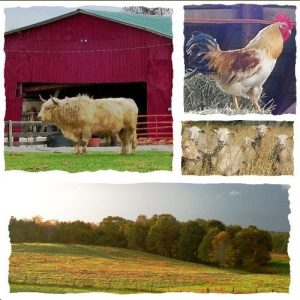

This is the second week of the month. That means I am headed over to Westpoint, Tennessee on Thursday, March 12, to join Franklin Sanders and his family for dinner at the Sanders homestead down the road from their Top of the World Farm.

A lively dinner discussion will be followed by our monthly precious metals update by bridge call for this week’s Solari Report.

Last month, Franklin and I covered the most frequently asked questions that Franklin and his team at The Moneychanger get about buying gold and silver coins. This includes his Ten Commandments of Gold and Silver Buying You can find this mp3 in The Solari Report archives.

This month, in addition to your latest questions, I want to cover the questions that I and the Solari team most often get about the gold and silver markets.

We will also be talking about Stanley Kubrick’s movie, Eyes Wide Shut, and important family safety issues you should understand in regards to the proposed national health database. I recommend my latest article, “The Data Beast.”

If you are a subscriber to The Solari Report, you can post your questions at your private panel or feel free to also post them at this blog post. If you would like to learn more about The Solari Report and subscribe, click here.

Catherine,

My head is spinning with the whole phenomenon around gold. This question came from “PayAttention” at http://www.emsnews.wordpress.com... and I’m repeating it here in the hopes that you pose this to Franklin and James Turk. I am too broke to contribute to GATA unless ten dollars would help, or a case of tuna fish to the Tennessee Hillbilly.

>>> You do not find it unsettling that your tax dollars are funding the foreign Deutsche Bank so that it can continue to arbitrage the difference between CDS spreads and corporate debt discounts while selling short equity. This may sound exotic, however the February/March market crash has been funded by your retirement money. Can I put it any more directly to you?

THE LARGEST SHORT POSITIONS ON THE COMEX GOLD FUTURES ARE HELD BY JPM, ANOTHER BENEFICIARY OF YOUR GIFT TO AIG. <<<<<

Hi Franklin

I want to buy $100,000.00 of silver, in part so I can play the gold/silver ratio, but the thought of storing, shipping, etc. approx 450 pounds of silver leaves me cold. What are my alternatives?

LongOfTooth

P.S. I’m in the process of looking into doing this through GoldMoney but there are unresolved issues which until they are clarified makes this an option I can’t take.

What are the chances of us going on the gold standard now? Do you still think collapse is a couple or few years off? With Fema camps on military bases and spying on American info do you think it is safe to stay here? Do you think countries like New Zealand could be taken over by China? Or how about America? Will we have war on our soil? What is the liklihood? Will the country separate into FEMA regions Congress designated in spring 2008 with various areas going to various countries like the NW going to Canada and California going to China? What is the liklihood of the Amero of us uniting with Canada and Mexico? Why all the unrest in Mexico?

Also at what point would you sell your gold and silver?

Ditto to Leigh McKeiman & LongOfTooth, I’m asking all the same questions above????