No posts

“How the hell do you know that it’s going to stop at 21 [million]. I’ve never met one person who told me that they know for a fact.”

~ Jamie Dimon at the World Economic Forum in Davos

Read the PDF: Single-page or double-page

View video presentation of briefing for state legislators and officials

Hard copies of Bitcoin Bailout are available at the Solari Shop

Bitcoin (BTC) is a cryptocurrency—a private digital currency that does not depend on a central bank, commercial bank, or government to manage or take responsibility for it.

The Bitcoin design was published in 2008 by Satoshi Nakamoto, presumed to be a pseudonym for an unknown or group of unknown software developers. Bitcoin use began in 2009 on an open source basis. Bitcoin transactions are recorded on a public distributed ledger called a blockchain.

As of December 24, 2024, the total number of Bitcoins in circulation was reported to be 19,800,734, and the total market capitalization of Bitcoin was $1.9 trillion, making Bitcoin the most popular form of cryptocurrency. Bitcoin’s price and market capitalization are highly volatile—the price of a Bitcoin has ranged during 2024 from a low of approximately $38,000 to a high of $108,000.

Bitcoin (Wikipedia)

Cryptocurrency Prices and Market Capitalization (Coinbase)

As of 2023, approximately 14.6% of American adults are estimated to own cryptocurrency, with three times more men owning crypto than women. According to a Pew Research Center study published in October 2024:

“Roughly six-in-ten Americans (63%) say they have little to no confidence that current ways to invest in, trade or use cryptocurrencies are reliable and safe. This includes three-in-ten adults who say they are not at all confident, and a third who say they are not very confident.

Just 5% of adults are extremely or very confident in cryptocurrencies, and 18% are somewhat confident.

These findings are largely similar to what the Center found in March 2023.”1

How Many Americans Own Crypto? (Coinweb, 2024 statistics)

Majority of Americans Aren’t Confident in the Safety and Reliability of Cryptocurrency (Pew Research Center)

Bitcoins are created by Bitcoin mining. This is described by Investopedia as follows:

“Bitcoin mining is a network-wide competition to generate a cryptographic solution that matches specific criteria. When a correct solution is reached, a reward in the form of bitcoin and fees for the work done is given to the miner(s) who reached the solution first.”2

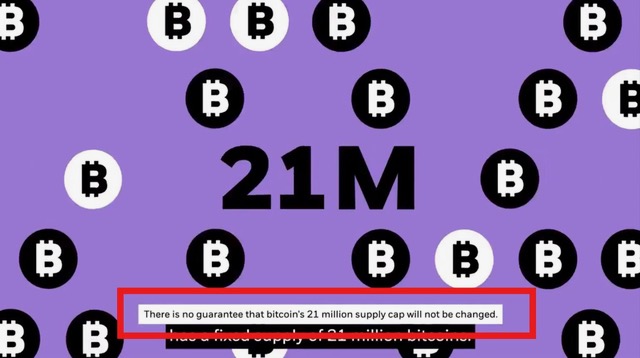

The initial Bitcoin design was set up to create 21MM Bitcoin, of which 19.8MM are officially reported to have been created as of December 2024. However, that limit can be changed—it is by no means firm. There is no law, regulation, or enforcement mechanism that limits the number of Bitcoins that can be mined, and those in control of the stated limit are software programmers, in a system that operates solely on trust. There is no way to audit or confirm the existence of the total number of Bitcoins that holders believe they own.

BlackRock is the sponsor of the largest Bitcoin exchange-traded fund (ETF)—the iShares Bitcoin Trust (IBIT). An ETF is a securities vehicle formed as a trust designed to be purchased by investors through the brokerage system and stock and bond markets. The idea behind a Bitcoin ETF is that the investor buys shares in the ETF and the trust uses the proceeds to buy and hold Bitcoin through a custodial arrangement.

Launched in January 2024, BlackRock’s IBIT ETF has grown to a market capitalization of $48 billion. It is described on Yahoo! Finance as follows:

“The shares are intended to constitute a simple means of making an investment similar to an investment in bitcoin rather than by acquiring, holding and trading bitcoin directly on a peer-to-peer or other basis or via a digital asset exchange.”3

BlackRock describes the investment objective as, “The iShares Bitcoin Trust ETF seeks to reflect generally the performance of the price of bitcoin.”

BlackRock Fund Advisors, as the trustee of the IBIT trust, is subject to U.S. securities laws governing disclosure to investors because shares in IBIT are securities. Rule 10b-5 under the Securities Exchange Act requires that any information material to an investment decision be disclosed to investors in considering whether to purchase or sell shares.

BlackRock recently published a video4 on Bitcoin that included a disclaimer that “There is no guarantee that Bitcoin’s 21 million supply cap will not be changed.” Interestingly, the IBIT prospectus5 includes a reference to a legal opinion on certain tax matters, but there is no legal opinion about the alleged share limit and no disclosure as to the risks of the investment in IBIT shares as there would be in, for example, a prospectus for an investment in common stock or bonds.

BlackRock’s disclosure echos statements6 by investor Charlie Munger in 2017 warning of the “flexibility” of the Bitcoin issuance limit, as well as a recent statement7 by entrepreneur Peter Thiel, who implied that he did not see where the investors would come from to keep the speculation in Bitcoin going.

In addition to questions about the potential for future increases in the number of Bitcoins that can be mined, there are reports (e.g., in Hijacking Bitcoin8) of “inflation bugs” in the Bitcoin software and concerns that the Bitcoin ETFs issued by BlackRock, Fidelity, and other securities firms may not be fully collateralized, given questions that have arisen regarding precious metals ETFs as well as in the mortgage markets.

Bitcoin is often promoted as a protection against inflation because the number of outstanding coins is limited. In fact, this is an illusion because the number of outstanding Bitcoins is determined by a small group of private parties who are not yet subject to clear standards of regulation and disclosure.

What Is Bitcoin Mining? How to Get Started (Investopedia)

iShares Bitcoin Trust (IBIT) (Yahoo! Finance)

iShares Bitcoin Trust ETF (BlackRock)

BlackRock Video (Bitcoin Magazine)

Charlie Munger on Bitcoin Limit (2017)

Peter Thiel Is Telling You that BTC Was Hijacked

BlackRock Just Quietly Confirmed a Devastating Bitcoin Price Bombshell (Forbes)

600 Microseconds: A perspective from the Bitcoin Cash and Bitcoin Unlimited developer who discovered CVE-2018–17144 (Medium/Bitcoin Unlimited)

The Latest Bitcoin Bug Was So Bad, Developers Kept Its Full Details a Secret (CoinDesk)

Inflation Bug Still a Danger to More Than Half of All Bitcoin Full Nodes (Cointelegraph)

GLD and SLV: Disclosure in the Precious Metals Puzzle Palace (Solari Report)

The Bitcoin blockchain is maintained by the Bitcoin miners who cover their expenses through new Bitcoin they create as well as transaction fees. There are questions as to whether they can generate sufficient transaction fees in the future to maintain the network on a sustainable basis. A significant challenge is that Bitcoin is exceptionally energy-intensive, generates significant demand for water and hardware infrastructure, and creates e-waste. As of December 9, 2024, Bitcoin’s annual consumption of energy was estimated to be equal to 4.1% of U.S. annual energy consumption, 30.7% of that of Canada, 54% of that of the United Kingdom, 150.2% of that of the Netherlands, and 251.6% of that of the Czech Republic.

Fundamental economics and environmental impacts and related municipal pushback raise questions about the viability of the Bitcoin ecosystem. From a public policy standpoint, one may question the wisdom of dedicating increasingly scarce energy, water, and mineral resources to a product that has no underlying productive purpose and functions primarily to serve the interests of speculators.

Bitcoin Average Energy Consumption per Transaction Compared to that of VISA as of May 1, 2023 (Statista)

Bitcoin Miners in Texas Shut Down to Save Power (Bloomberg Technology)

Environmental Impact of Bitcoin (Wikipedia)

Granbury Residents Sue Local Bitcoin Mine over Health Threatening Noise Pollution (Earthjustice)

Russia Bans Crypto Mining for 6 Years in 10 Regions (Cointelegraph)

There is limited information regarding Bitcoin holdings. Although ownership has since expanded, an MIT study published in 2021 described characteristics that continue to apply:

“The authors found that participation in Bitcoin is skewed toward the elite. Their research showed that at the end of 2020, there were 1,000 ‘clusters’ controlling 2 million bitcoins.

The authors clustered addresses so that all addresses that sent bitcoins in any single transaction were deemed to belong to the same entity. [Author] Schoar said this often happens for the sole purpose of obfuscating the origin of funds. In addition, the top 10,000 clusters owned more than 4 million bitcoins—about a quarter of all outstanding bitcoins. This has important implications for market stability.

‘Somebody who can easily spend a hundred million dollars worth of Bitcoin and sell it or buy it can have a massive price impact in the market,’ Schoar said. ‘That’s typically a situation we don’t like, because it means as a regular retail investor, you might suddenly find yourself x percent down because of massive volatility, which might be created by a few large investors randomly deciding to sell some of their holdings.”9

This raises important questions. Given that the Bitcoin market is relatively illiquid, how can the early investors with significant percentage holdings that represent a significant percentage of total outstanding Bitcoin liquidate their investments? And if and when they do liquidate, how can they get the highest price possible? And then, how can they avoid significant capital gains taxes?

Bitcoin: Who Owns It, Who Mines It, Who’s Breaking the Law (MIT Sloan School of Management)

The Ten Biggest Holders of Bitcoin and the Billions They Are Worth (CCN)

Bitcoin was initially designed as a decentralized global payment system that, if adopted, had the potential to facilitate low-cost global transactions and provide a decentralized transaction system that supplemented and was an alternative to sovereign currencies. Instead, a small group of software developers assumed control of the system and rules, shifting the system to one that had high transaction fees, was relatively illiquid, and was promoted as a digital asset. The result is that Bitcoin does not serve a utilitarian or practical function. Rather, it serves primarily its early adopters as a speculative asset. Consequently, the price and market liquidity depend on attracting more people to buy Bitcoin as a speculative asset, hoping that its price will go up.

In early 2023, economists at the Bank for International Settlements (BIS) estimated that most retail investors in Bitcoin had not yet achieved a positive return on their investment. Another challenge for potential investors is the level of fraud in the crypto marketplace. In 2023, the FBI received approximately 69,000 complaints regarding cryptocurrency fraud totaling $5.6 billion. According to the FBI Cryptocurrency Fraud Report 2023, “While the number of cryptocurrency-related complaints represents only about 10 percent of the total number of financial fraud complaints, the losses associated with these complaints account for almost 50 percent of the total losses.”10 In part, this reflects the absence of a clear regulatory structure and strong industry standards and practices for the crypto markets.

In April 2024, Roger Ver and Steve Patterson published a detailed and highly documented history of Bitcoin’s evolution from payment system to speculative digital asset, titled Hijacking Bitcoin: The Hidden History of BTC. This is an excellent overview for any government official or policymaker considering Bitcoin proposals or regulatory treatment.

Shortly after Hijacking Bitcoin was published, the Department of Justice (DOJ) targeted Roger Ver, allegedly based on questions regarding his exit taxes when he renounced his U.S. citizenship in 2014. As an early investor in Bitcoin, Ver’s holdings would be an attractive acquisition for the DOJ Assets Forfeiture Fund in the process of building positions in Bitcoin. The U.S. Marshals Service, which manages the DOJ Assets Forfeiture Fund, uses Coinbase as a custodian for seized Bitcoin, as does IBIT (the BlackRock Bitcoin ETF), which is growing rapidly.

Crypto Shocks and Retail Losses (BIS)

Americans Lost $5.6 Billion Last Year in Cryptocurrency Fraud Scams, the FBI Says (AP)

Cryptocurrency Fraud Report 2023 (FBI)

Hijacking Bitcoin: The Hidden History of BTC

Hijacking Bitcoin: The Hidden History of BTC with Steve Patterson (Solari Report)

Assets Forfeiture Fund (AFF) (DOJ)

Several proposals for a Bitcoin strategic reserve were floated during the 2024 U.S. presidential election campaign.

At the Bitcoin 2024 conference in Nashville in July, President Trump promised, if elected, to fire Securities and Exchange Commission (SEC) Chairman Gary Gensler, whose regulatory policies and enforcement are unpopular with the crypto industry. In addition, Trump proposed halting sales of existing DOJ holdings of approximately 208,000 Bitcoins representing asset seizures and moving the position to Treasury as a permanent holding. This would ease downward price pressure in the relatively illiquid Bitcoin market.

To great applause, at that same conference Robert F. Kennedy Jr. proposed a long-term mandated Bitcoin buying program by the federal government, promising that this would raise the Bitcoin price significantly. He also proposed that sellers should be allowed to remain confidential and have the opportunity to reinvest their proceeds on a tax-free basis by qualifying the exchange of Bitcoin for real estate as a qualifying Section 1031 like-kind exchange.11 This could result in extraordinary windfall profits to the “Bitcoin billionaires.”

The first Trump Administration, in 2018 in response to lobbying by the tech industry, created a tax vehicle called Opportunity Zones. Currently, capital gains from cryptocurrency transactions can be reinvested tax-free in Opportunity Zone assets.

Trump Transition Co-Chair Howard Lutnick, now nominee for Secretary of Commerce, also spoke at the Bitcoin 2024 conference. Lutnick is Chairman of primary dealer Cantor Fitzgerald, the leading manager of stablecoin Tether’s investments in U.S. Treasury securities.

The candidates’ very presence at Bitcoin 2024 reflected the significant increase in donations from the crypto industry and investors. The crypto industry was the largest corporate donor industry category during the 2024 election campaign, with over $200 million of donations.

Subsequent to the election, numerous proposals for government Bitcoin strategic reserves have been floated by crypto enthusiasts. Legislators are experiencing astroturf lobbying efforts, and federal and state legislation has been proposed that would mandate or permit the federal and state purchase or holding of Bitcoin and permit the payment of state taxes with Bitcoin.

How such purchases would be financed is not yet clear. At the federal level, purchases could be financed from appropriations, which depend on sales of Treasury notes and bonds, a growing percentage of which are purchased by American retirement funds or monetized through the Federal Reserve in a way that is driving inflation. Another source of funding for Bitcoin strategic reserves could be asset seizures by the DOJ.

Bitcoin lobbyists have suggested the following questionable reasons for such an investment by a government:

Of course, such lobbyists make no mention of the energy and technology consumption and environmental stress that would necessarily accompany such a reserve, the volatile nature of the crypto markets, or the regressive nature of a system in which working class, government, and other workers’ retirement accounts are used to fund the buy-out of Bitcoin billionaire crypto positions. If the returns on Bitcoin to date are dependent on attracting more speculators into a Ponzi-type speculation, it is clear that there will be no investor large enough to keep the historical returns going.

The central banks and large gold investors have traditionally generated revenues on their precious metals inventories by leasing their gold; this is one of the reasons there are concerns about collateral risks in the precious metals markets. Clearly, the Treasury could lease Bitcoin holdings to ETFs, which could solve the exchange-traded funds’ challenge of acquiring Bitcoin in a relatively illiquid market. This would make it easier for BlackRock, Graystone, Fidelity, and other ETF sponsors to market their Bitcoin ETFs to institutional investors, including state pension funds.

States typically run balanced budgets using tax collections (and sometimes borrowing) to fund current expenses. Acceptance of Bitcoin in payment of state user fees and taxes for long-term holding would tie up current revenues and require increased borrowing, higher taxes, or cutting expenses. If state investment guidelines are modified to treat Bitcoin as a “permitted investment” for state rainy day funds or state pension funds, state fund managers would necessarily sell investments in real and performing assets—including real estate, securities backed by real assets, bank certificates of deposit, and bonds of federal, municipal, and corporate enterprises—in order to invest in speculative assets. Doing so would generate no productive economic activity other than the generation of profits for speculators, including the early Bitcoin insiders and billionaire campaign donors.

Questions for RFK Regarding Your Proposed Bitcoin Executive Orders (Solari Report)

The Crypto Trio: How the Cryptocurrency Industry Has Made Its Mark on 2024 Elections (Open Secrets)

Crypto Industry Political Donations Top $200M: Biggest Donors in the 2024 Presidential Race (CCN)

We can see why large Bitcoin holders would want federal and state buying programs to help them increase prices and create a sufficiently liquid market to make it possible to exit their positions, particularly before the Bitcoin ecosystem becomes unsustainable and the competition for increasingly scarce energy resources and the growing environmental damage become more widely understood. We can also see why ETF sponsors would view federal and state purchases and holdings as a highly profitable way to build their asset management business in digital assets. Finally, we can see why some politicians might be interested in campaign donations that could result from the facilitation of donor profit-taking through large crypto sales and ballooning government investment in digital assets.

However, using taxpayers’ and state pension funds’ money to fund Bitcoin reserves serves no public purpose. If citizens want to purchase speculative digital assets in a dark market, they can do so on their own accord. They should not be forced to do so by government mandates that represent a reverse Robin Hood scheme where the government takes from the poor to give to the rich.

If government can afford to buy private crypto assets, it can afford to—and should—cut taxes instead. Let citizens decide if, in what, and when they wish to speculate. Citizens do not need Bitcoin to fight inflation. What they could use to fight inflation is lower taxes, basic infrastructure, and public services that support a productive economy. These are the types of investments that generate the healthy children, strong education, skills-building, and entrepreneurial activity that lead to employment and income growth. Citizens do not need government to use their precious resources to further speculative bubbles that increase the income gap.

Sources:

Plunder Capitalism: Is the Bitcoin Strategic Reserve Trial Balloon the Next Step in the Great American Land Grab? (Solari Report)

Subscribers can post feedback and comments below or at Ask Catherine & the Solari Team.

Solari provides a monthly online briefing for state legislators and officials and their staffs on actions they can take to protect financial transaction freedom and state sovereignty. During the briefing on January 9, 2025, Catherine addressed why states should reject proposals for Bitcoin bailouts and answer participants’ questions.

Use this template to write a letter to your state legislators about the proposed “Bitcoin Strategic Reserves.”

Read the Bitcoin Bailout PDF: Single-page or double-page

The Solari Papers #1: Reversing the Financial Coup d’Etat—Critical Issues in U.S. Federal Finances: A Briefing Memo for U.S. Federal and State Candidates and Legislators by Catherine Austin Fitts (August 2023)

The Solari Papers #2: U.S. State Bullion Depositories by Catherine Austin Fitts and the Solari Team (January 2024)

The Solari Papers #3: Musings on the Department of Defense by Catherine Austin Fitts (June 2024)

Already a subscriber?

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

Your cart is currently empty!

Notifications