2017 Annual Wrap Up Triple Header - Equity Overview, Rambus Chartology & Precious Metals

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

2017 Annual Wrap Up Triple Header – Equity Overview, Rambus Chartology & Precious Metals

“To concentrate the mind, I fantasize about managing Stalin’s pension fund where the penalty for failing to deliver 4.5% real per year over 10 years is death.” ~Jeremy Grantham

By Catherine Austin Fitts

This week on The Solari Report, I will present the Annual Equity Overview for 2017 and the Rambus Chartology Annual Review. In addition, Franklin Sanders of The Moneychanger will join me to review the precious metal markets in 2017 and the outlook for 2018.

In 2017, equity markets outperformed the general economy – by a lot. The question is – how long can this last? How long can investors achieve returns that are significantly superior to returns to labor, taxpayers, and the general economy – and do so without significant increases in productivity? Clearly tax reform will help as corporate tax contributions continue to decline as a percentage of government budgets.

Gold prices also outperformed, with gold producing its first double digit returns since 2010.

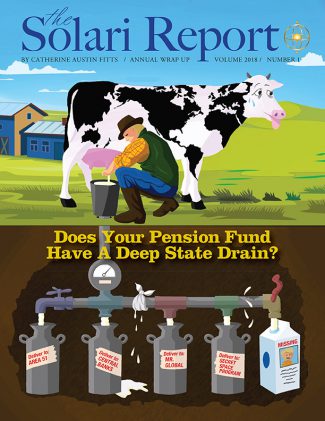

A review of global equity markets and our annual scenarios for 2018 is an appropriate lead into the following week theme on pensions funds. I ask the question, “Does Your Pension Fund Have a Deep State Drain?”

Make sure you check out Part I and Part II of News Trends and Stories with Dr. Joseph Farrell and our announcements for the winners for our 2017 awards:

- Hero of the Year: Dr. Mark Skidmore

- Documentary of the Year: Richard Dolans False Flags

- Movie of the Year: Dunkirk

In Money & Markets this week I will discuss the latest in financial and geopolitical news.

In Let’s Go to the Movies, I will review Tom Cruise’s new film American Made about Barry Seal, the CIA pilot who ran a multibillion operation out a small airport in Mena, Arkansas. Seal used to make drops at Area 51 between running weapons to South America and returning with cocaine. He was assassinated with George H. W. Bush’s personal phone number in his little black book. I will talk about what this all has to do with the FBI investigation of the Clinton Foundation, the reported 9,000 sealed indictments around the country, Attorney General Sessions decision to return to pre-Obama marijuana enforcement, why American troops are still in Afghanistan guarding poppy fields and what that all has to do with securities outperforming the general economy on a long-term basis.

Make sure to post or e-mail your questions for Ask Catherine.

Talk to you Thursday!

8 Comments

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

8 Comments

-

#ReleaseTheMemo – Qanon – Letters to Facebook & Twitter from Congress – Secret (FBI) Societies –

Whew! Getting a little odd around the headlines this week! #NotInKansas

So Kudos to your analysis on real estate over the next inflationary period (interview with Franklin). Every other person automatically says that when interest rates go up, that real estate will automatically decline in value. However, during a period of high and sustained inflation, asset get divided into two main categories – paper-based and tangible.

In the inflationary period between 1973 – 82, California real estate prices increased 367% during a time when mortgage rates went from 8% to 17%. This resulted in the typical mortgage payment increasing more than 650%!! People dumped their cash (paper) into real estate (tangible). Reagan’s first message during his inauguration dealt with the ravages of inflation.

So with billions of expatriated dollars coming back on shore & the newly reduced taxes, I expect that residential real estate will increase in value over the next five years (n economically stable / strong areas). Commercials, as you say, is being hollowed out by Amazon, et al.

We live in VERY interesting times … so glad for your inputs and views as we all take this journey together!!

All the Best!!

-

🙂 Yup. REITS are down – because of rising interest rates. So it depends on where the Fed, the Fed and the 3.0 thieves are injecting the money.

-

-

#ReleaseTheMemo – Qanon – Letters to Facebook & Twitter from Congress – Secret (FBI) Societies –

Whew! Getting a little odd around the headlines this week! #NotInKansas

So Kudos to your analysis on real estate over the next inflationary period (interview with Franklin). Every other person automatically says that when interest rates go up, that real estate will automatically decline in value. However, during a period of high and sustained inflation, asset get divided into two main categories – paper-based and tangible.

In the inflationary period between 1973 – 82, California real estate prices increased 367% during a time when mortgage rates went from 8% to 17%. This resulted in the typical mortgage payment increasing more than 650%!! People dumped their cash (paper) into real estate (tangible). Reagan’s first message during his inauguration dealt with the ravages of inflation.

So with billions of expatriated dollars coming back on shore & the newly reduced taxes, I expect that residential real estate will increase in value over the next five years (n economically stable / strong areas). Commercials, as you say, is being hollowed out by Amazon, et al.

We live in VERY interesting times … so glad for your inputs and views as we all take this journey together!!

All the Best!!

-

🙂 Yup. REITS are down – because of rising interest rates. So it depends on where the Fed, the Fed and the 3.0 thieves are injecting the money.

-

-

Any comment on trunews.com coverage of Davos? I understand President Trump sent them as part of his envoy.

https://www.trunews.com/listen/archives/2018/01-

Have not watched yet. Thanks for pointing that out!

-

-

Any comment on trunews.com coverage of Davos? I understand President Trump sent them as part of his envoy.

https://www.trunews.com/listen/archives/2018/01-

Have not watched yet. Thanks for pointing that out!

-

Comments are closed.

#ReleaseTheMemo – Qanon – Letters to Facebook & Twitter from Congress – Secret (FBI) Societies –

Whew! Getting a little odd around the headlines this week! #NotInKansas

So Kudos to your analysis on real estate over the next inflationary period (interview with Franklin). Every other person automatically says that when interest rates go up, that real estate will automatically decline in value. However, during a period of high and sustained inflation, asset get divided into two main categories – paper-based and tangible.

In the inflationary period between 1973 – 82, California real estate prices increased 367% during a time when mortgage rates went from 8% to 17%. This resulted in the typical mortgage payment increasing more than 650%!! People dumped their cash (paper) into real estate (tangible). Reagan’s first message during his inauguration dealt with the ravages of inflation.

So with billions of expatriated dollars coming back on shore & the newly reduced taxes, I expect that residential real estate will increase in value over the next five years (n economically stable / strong areas). Commercials, as you say, is being hollowed out by Amazon, et al.

We live in VERY interesting times … so glad for your inputs and views as we all take this journey together!!

All the Best!!

🙂 Yup. REITS are down – because of rising interest rates. So it depends on where the Fed, the Fed and the 3.0 thieves are injecting the money.

#ReleaseTheMemo – Qanon – Letters to Facebook & Twitter from Congress – Secret (FBI) Societies –

Whew! Getting a little odd around the headlines this week! #NotInKansas

So Kudos to your analysis on real estate over the next inflationary period (interview with Franklin). Every other person automatically says that when interest rates go up, that real estate will automatically decline in value. However, during a period of high and sustained inflation, asset get divided into two main categories – paper-based and tangible.

In the inflationary period between 1973 – 82, California real estate prices increased 367% during a time when mortgage rates went from 8% to 17%. This resulted in the typical mortgage payment increasing more than 650%!! People dumped their cash (paper) into real estate (tangible). Reagan’s first message during his inauguration dealt with the ravages of inflation.

So with billions of expatriated dollars coming back on shore & the newly reduced taxes, I expect that residential real estate will increase in value over the next five years (n economically stable / strong areas). Commercials, as you say, is being hollowed out by Amazon, et al.

We live in VERY interesting times … so glad for your inputs and views as we all take this journey together!!

All the Best!!

🙂 Yup. REITS are down – because of rising interest rates. So it depends on where the Fed, the Fed and the 3.0 thieves are injecting the money.

Any comment on trunews.com coverage of Davos? I understand President Trump sent them as part of his envoy.

https://www.trunews.com/listen/archives/2018/01

Have not watched yet. Thanks for pointing that out!

Any comment on trunews.com coverage of Davos? I understand President Trump sent them as part of his envoy.

https://www.trunews.com/listen/archives/2018/01

Have not watched yet. Thanks for pointing that out!