The Bell Tolls for the Bubble

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

The Bell Tolls for the Bubble

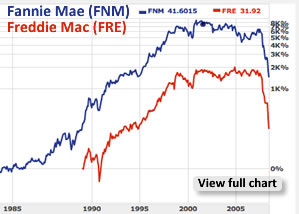

The inflation of the U.S. financial and mortgage finance stocks that began in the mid-1990’s with institution of the strong dollar policy, the suppression of the gold price and the movement of significant capital out of the US is now over. This coincides with a 20% drop in the stock market, an indication of a bear market.

The unanswered question is “how much will housing, land and other asset prices drop before the capital that was shifted out is attracted back on shore?”

Crisis Wipes $1 Trillion From Financial Stocks

By Joe Bel Bruno – Associated Press (7 Jul 2008)

One Comment

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

One Comment

-

Boy, you’ve really got to learn to duck when the excrement hits the ventilation device.

I’ll admit to being a bit of a skeptic; sometimes a conspiracy isn’t required to produce terrible results. But there is a quote from a Supreme Court Justice or maybe it was Adam Smith to the effect that whenever two or more businessmen have a chance to talk, collusion and price fixing can’t be far away.

So, leaving the cause aside if that is possible, the question I have is: what are the consequences of the Fannie/Freddie fiasco? Yes, they have something like $5 trillion–notice how everything seems to have increased an order of magnitude from billion to trillion these days–in mortgages out there. No, there is no way the US government is letting them go under. But what could the fix be? Will private capital come in to recapitalize them like we have seen with banks? Those early investors seemed like a pretty sophisticated bunch, lots of foreign money, sovereign wealth funds, but today it looks like they lost big amounts in a short amount of time. Will there be an appetite to undertake this again with Fannie and Freddie? Will the government have to explicitly guarantee this infusion of capital; will the government have to explicitly guarantee the debt these two have issued to keep their cost of borrowing low? For me the real tough one is: if the government steps in and starts issuing explicit guarantees on and for these companies what are the ramifications for the money supply? Yea, that $5 trillion is a big number but even if the government does the most aggressive move and guarantees the new source of capital, the companies’ debt, and all the paper they have pushed out that is based upon underlying mortgages is that the same as the government printing money. There is a source of money from the underlying mortgages to pay off the paper even with the increased rates of default. I recognize that we’ve been printing like crazy the past six years but is this the same thing? Also, the Fed seems to have hit a point of diminishing returns with the stimulus it can achieve by lowering rates and I’m no expert but long term rates don’t seem particularly responsive to the Fed’s latest actions–isn’t this similar to what happend in the 2001-2002 Greenspan era? We seem to have a banking system both domestically and globally that is unable to move the increased money supply because of the fear of counterparty risk and tightened loan standards so money supply is up but velocity is down. This seems similar to what happened in Japan after the collapse of their bubble in the 1980’s-1990’s. Their banks were unable and unwilling to recognize their bad loans, the government was unwilling to force the dead banks to fail and printed money like crazy; they just sputtered along the national debt ballooned, and they fell into a grinding deflationary spiral–while printing all that money.

I know we are having inflation. Anybody who has bought food–the price on the container of cereal is the same but the amount has decreased–or fuel sees that. But how do you adjust to what could be called stagflation? If the domestic and global economy goes into a recession because of rising commodity prices shouldn’t we expect a fall in commodity prices especially since this assets class seems to be the next bubble? So, if you chase hard assets at this stage, couldn’t you be in a bad position when the actual demand that underlies all the speculative money pumping up commodities decreases? That seems like a tough call because the cost of waiting and holding dollar denominated debt instruments has plenty of risk as you show. I just remember how gold fell dramatically when Volker jacked rates through the roof. That was not pretty. Wouldn’t a recession accomplish the same thing even if the Fed kept rates low? How do you adjust to dropping prices from lower demand while the printing presses are running full steam?

Have a nice weekend.

Comments are closed.

Boy, you’ve really got to learn to duck when the excrement hits the ventilation device.

I’ll admit to being a bit of a skeptic; sometimes a conspiracy isn’t required to produce terrible results. But there is a quote from a Supreme Court Justice or maybe it was Adam Smith to the effect that whenever two or more businessmen have a chance to talk, collusion and price fixing can’t be far away.

So, leaving the cause aside if that is possible, the question I have is: what are the consequences of the Fannie/Freddie fiasco? Yes, they have something like $5 trillion–notice how everything seems to have increased an order of magnitude from billion to trillion these days–in mortgages out there. No, there is no way the US government is letting them go under. But what could the fix be? Will private capital come in to recapitalize them like we have seen with banks? Those early investors seemed like a pretty sophisticated bunch, lots of foreign money, sovereign wealth funds, but today it looks like they lost big amounts in a short amount of time. Will there be an appetite to undertake this again with Fannie and Freddie? Will the government have to explicitly guarantee this infusion of capital; will the government have to explicitly guarantee the debt these two have issued to keep their cost of borrowing low? For me the real tough one is: if the government steps in and starts issuing explicit guarantees on and for these companies what are the ramifications for the money supply? Yea, that $5 trillion is a big number but even if the government does the most aggressive move and guarantees the new source of capital, the companies’ debt, and all the paper they have pushed out that is based upon underlying mortgages is that the same as the government printing money. There is a source of money from the underlying mortgages to pay off the paper even with the increased rates of default. I recognize that we’ve been printing like crazy the past six years but is this the same thing? Also, the Fed seems to have hit a point of diminishing returns with the stimulus it can achieve by lowering rates and I’m no expert but long term rates don’t seem particularly responsive to the Fed’s latest actions–isn’t this similar to what happend in the 2001-2002 Greenspan era? We seem to have a banking system both domestically and globally that is unable to move the increased money supply because of the fear of counterparty risk and tightened loan standards so money supply is up but velocity is down. This seems similar to what happened in Japan after the collapse of their bubble in the 1980’s-1990’s. Their banks were unable and unwilling to recognize their bad loans, the government was unwilling to force the dead banks to fail and printed money like crazy; they just sputtered along the national debt ballooned, and they fell into a grinding deflationary spiral–while printing all that money.

I know we are having inflation. Anybody who has bought food–the price on the container of cereal is the same but the amount has decreased–or fuel sees that. But how do you adjust to what could be called stagflation? If the domestic and global economy goes into a recession because of rising commodity prices shouldn’t we expect a fall in commodity prices especially since this assets class seems to be the next bubble? So, if you chase hard assets at this stage, couldn’t you be in a bad position when the actual demand that underlies all the speculative money pumping up commodities decreases? That seems like a tough call because the cost of waiting and holding dollar denominated debt instruments has plenty of risk as you show. I just remember how gold fell dramatically when Volker jacked rates through the roof. That was not pretty. Wouldn’t a recession accomplish the same thing even if the Fed kept rates low? How do you adjust to dropping prices from lower demand while the printing presses are running full steam?

Have a nice weekend.