Muni Bond Market Throwdown: How Bad Could Defaults Get?

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

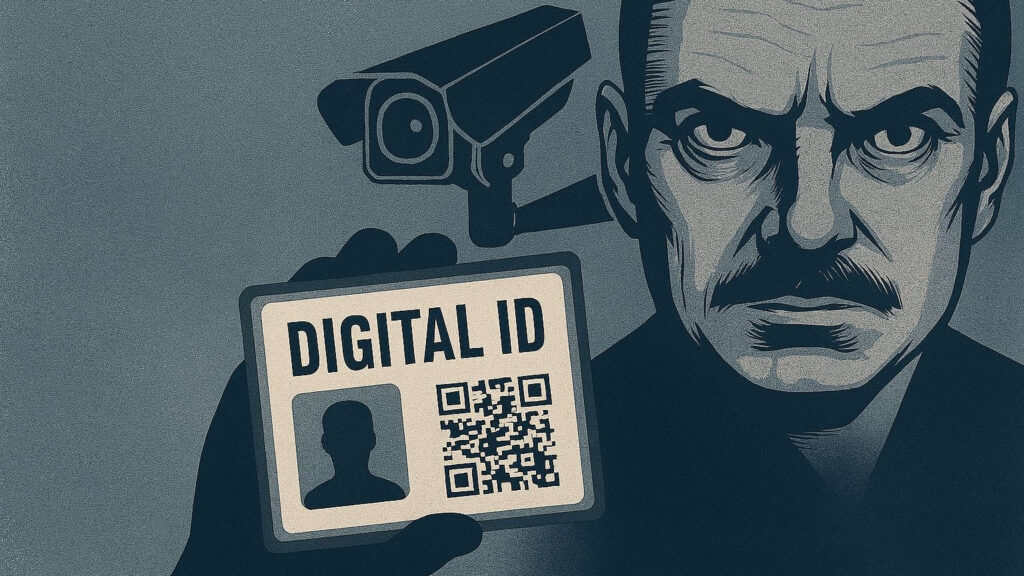

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Muni Bond Market Throwdown: How Bad Could Defaults Get?

By Louis Lanzano

Star banking analyst Meredith Whitney has been saying for months that the next phase of the housing meltdown would be a local-government financial crisis. Last weekend she put a number on it, asserting that “hundreds of billions of dollars” of municipal bond debt would end up in default.

Whitney, appearing on CBS’ “60 Minutes,” was interviewed on correspondent Steve Kroft’s segment on the “day of reckoning” for municipal finances.

Given the pounding that the tax-free muni market has taken since late October, driving bond prices down and yields up, Whitney’s comments were a bond salesman’s worst nightmare. The segment aired just after the muni market seemed to be stabilizing late last week.

So far this week the market has remained relatively calm, although a report Wednesday from the mutual fund industry’s trade group showed that muni fund redemptions jumped in the seven days ended Dec. 15 as more investors opted to cash out.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.