The War for Bankocracy

Episode II

A Government Unto Itself

A Series by John Titus

Episode II

The War for Bankocracy - Episode II - A Government Unto Itself

The first episode in the series, “Warning Shot,” demonstrated that the most controversial statement in The Biden White House memo–namely, that nearly all advanced economies “are governed by independent central banks”–is wrong as a matter of law due to the U.S. Constitution. Because sovereign powers in the U.S. are delegated across three branches of government, the Federal Reserve doesn’t “govern” anything in the U.S. beyond what powers Congress delegated the Fed in the Federal Reserve Act.

On that score: the Fed controls every dollar it issues as Federal Reserve notes–cash–and it exerts enormous control over all $17.5 trillion in bank deposits. And all of that is quite aside from the control that the Fed exercises over retail banks as their top regulator. For all intents and purposes, the Fed controls the U.S. money supply.

The question of the Fed’s power thus becomes, where does monetary control and the power of money issuance rank among other sovereign powers like raising standing armies and issuing laws?

The answer, at least since 1694, is #1. Specifically, the power to coin money has been the apex sovereign power in nations since 1694, when the creation of the Bank of England introduced private money issuance at the sovereign level to the world. It was this development that caused money-coining to surpass the raising of standing armies as the apex sovereign power.

Before 1694, as Niccolo Machiavelli had it, “men and steel could find money and bread,” but not vice versa. In other words, so long as soldiers could find monied men, soldiers were top dog. That founding of the Bank of England in 1694 changed that dynamic forever, however. Affirming the tectonic power shift that took place after 1694, Thomas Jefferson wrote that “banking establishments are more dangerous than standing armies.”

Episode 2 traces that massive power shift to two crucial features of the Bank of England when it was founded in 1694–features that took Machiavelli’s reasoning off the table: first was the Bank of England’s private and anonymous ownership, second its issuance of debt-based money.

Importantly, the episode points out, the Federal Reserve replicates both of those features.

Thankfully, however, there are limits on the Fed’s power in the U.S. The Constitution, written in 1787 following a long war with England largely over the right to coin money, put the money-coining power in the hands of directly elected representatives, i.e., in congress. Thus even today, the Fed’s claim to “independent” status is not any stronger than a renter in possession of a home posing as its owner, as pointed out in the last episode.

There is thus enormous tension within the U.S. power structure: as a factual matter, the apex sovereign power of money-coining rests in the hands of privately owned banks; but that power is only rented.

In the U.S., the Fed–undeniably powerful though it is–cannot achieve sovereign status due to the Constitution. The European Central Bank, by way of contrast, is the legal owner of its apex sovereign power and thus is the ranking sovereign power in Europe.

Nevertheless, despite its legally subordinate status, the Fed acts “as a government to itself” by repeatedly thumbing its nose at congress, its creator. The question is how far the Fed is willing to go in order to extend its power–legally or otherwise?

A good answer can be found by closely scrutinizing the Fed’s argument for independence based on the facts, which is actually not an argument at all but something else entirely–and is the subject of the next episode.

Clips list – in order of appearance :

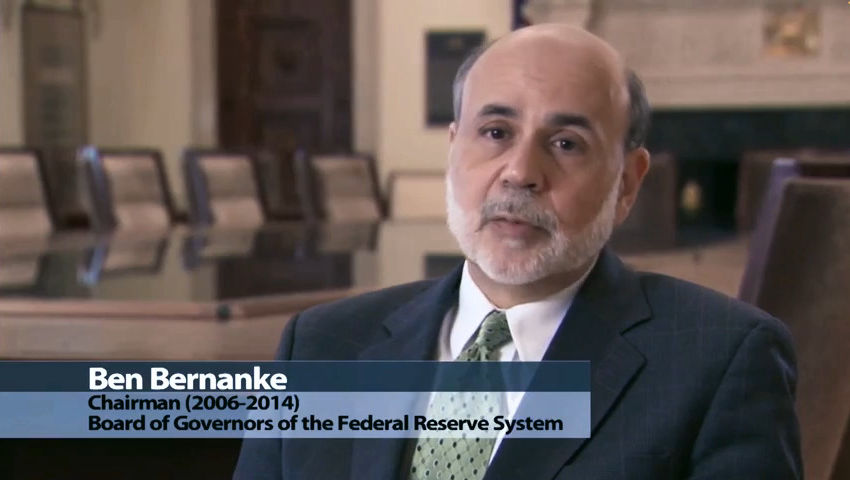

- The Federal Reserve’s Dual Mandate – Ben Bernanke

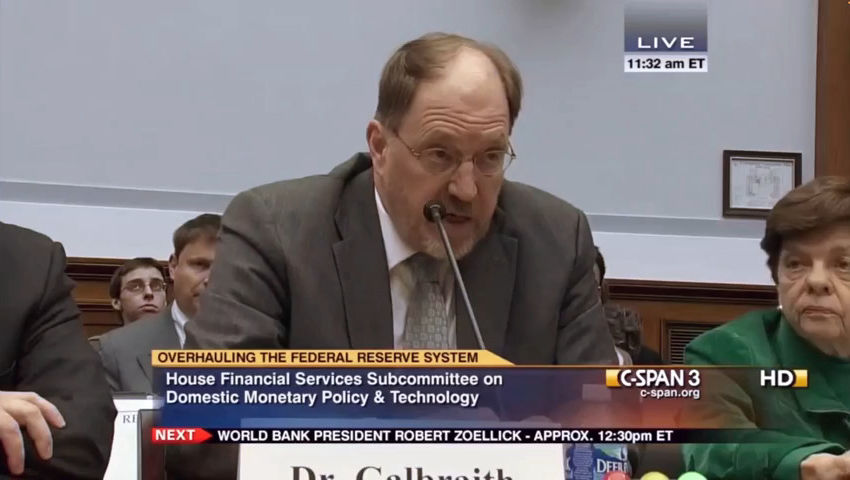

- Galbraith Fed Creature Cong May 08 2012 davcc

- Paul – Galbraith Fed govt unto itself

- sanders-bernanke intro legislation

Sources:

- March 3, 2009 – Economic and Budget Challenges for the Short and Long Term

- Thomas Jefferson to John Taylor, May 28, 1816

- May 8, 2012 – Improving the Federal Reserve System: Examining Legislation to Reform the Fed and Other Alternatives

- Machiavelli’s the Art of War by Dr. Kanchan Mishra

- July 9, 2009 – Regulatory Restructuring: Balancing the Independence of the Federal Reserve in Monetary Policy with Systemic Risk Regulation

- May 22, 2024 – The Importance of Central Bank Independence

- Federal Reserve Act

(13) “The Importance of Central Bank Independence,” May 22, 2024, White House Council of Economic Advisers

(14) https://staging.solari.com/the-war-for-bankocracy

(15) Econ. and Budget Challenges for the Short and Long Term, Hearing Before the Comm. on the Budget, U.S. Senate, 111th Cong. (Mar. 3, 2009)

(16) Federal Reserve Balance Sheet: Factors Affecting Reserve Balances – H.4.1, Sept. 26, 2024, https://www.federalreserve.gov/releases/h41/20240926/

(17) FDIC Statistics at a Glance – Latest Industry Trends, Sept. 30, 2024

https://www.fdic.gov/quarterly-banking-profile/latest-industry-trends-september-2024-pdf

(18) “Mommy, Where Does Money Come From?,” by John Titus, Apr. 16, 2019; see https://www.youtube.com/watch?v=S_dBKAWHHQI

(19) Assets and Liabilities of Commercial Banks in the United States – H.8, Oct. 25, 2024, https://www.federalreserve.gov/releases/h8/20241025/

(20) “Fed Admits Crony Truth About Pandemic QE: ‘it creates new bank deposits’,” by John Titus, Sept. 5, 2022; see https://www.youtube.com/watch?v=n1xgQeCiu6k

(21) “Deep Diving the Fed’s Killer Whale Crisis,” by John Titus, June 6, 2023; see https://www.youtube.com/watch?v=1sCq9FJQQNA

(22) Niccolo Machiavelli, The Art of War (1520).

(23) The Works of Thomas Jefferson, vol. 11 (Paul Leicester Ford, ed., 1905).

(24) Stephen Zarlenga, The Lost Science of Money (2002).

(25) Alexander Del Mar, The History of Money in America, From the Earliest Times to the Establishment of the Constitution (1899).

(26) Alexander Del Mar, History of Monetary Systems (1895).

(27) Federal Reserve Balance Sheet: Factors Affecting Reserve Balances – H.4.1, Jan. 30, 2025; https://www.federalreserve.gov/releases/h41/20250130/h41.pdf

(28) Citigroup Inc. 2024 Notice of Annual Meeting and Proxy Statement Apr. 30, 2024; https://www.citigroup.com/rcs/citigpa/storage/public/Citi-2024-proxy-statement.pdf

(29) BlackRock 2023 Proxy Statement, May 24, 2023; https://s24.q4cdn.com/856567660/files/doc_financials/2023/ar/blackrock-2023-proxy-statement_vf.pdf

(30) Improving the Fed. Reserve Sys: Examining Legislation to Reform the Fed and Other Alternatives, Hearing Before the Subcomm. on Domestic Monetary Policy and Tech. of the Comm. on Fin. Servs., U.S. House of Representatives, 112th Cong. (May 8, 2012)

(31) European Central Bank, Statute of the ECSB and of the ECB, Institutional Provisions, Protocol as annexed to the Treaty on the European Union (2010/C 83/01); https://www.ecb.europa.eu/pub/pdf/other/ecbinstitutionalprovisions2011en.pdf

(32) Regulatory Restructuring: Balancing the Indep. of the Fed. Reserve Sys. in Monetary Policy With Systemic Risk Reg., Hearing Before Subcomm. on Domestic Monetary Policy and Tech. of the Comm. on Fin. Servs., U.S. House of Representatives, 112th Cong. (July 9, 2009)

(33) John Titus

9660 Falls of Neuse Rd

Suite 138, No. 241

Raleigh, NC 27615

Also Referenced:

Here you’ll find the original clips referenced in this episode.

The War for Bankocracy - Episode II - A Government Unto Itself

Senator Bernie Sanders - Hearing Before the Comm. on the Budget, U.S. Senate, 111th Cong. (Mar. 3, 2009)

Representative Ron Paul - Federal Hearing Before Subcommity on Domestic Monetary Policy and Tech (July 9, 2009)

James Galbraith - Hearing Before the Subcommity, On Domestic Monetary Policy and Tech (May 8, 2012)

The Federal Reserve's Dual Mandate - Ben Bernanke

Click To Download PDF’s

- March 3, 2009 – Economic and Budget Challenges for the Short and Long Term

- Thomas Jefferson to John Taylor, May 28, 1816

- May 8, 2012 – Improving the Federal Reserve System: Examining Legislation to Reform the Fed and Other Alternatives

- Machiavelli’s the Art of War by Dr. Kanchan Mishra

- July 9, 2009 – Regulatory Restructuring: Balancing the Independence of the Federal Reserve in Monetary Policy with Systemic Risk Regulation

- May 22, 2024 – The Importance of Central Bank Independence

- Federal Reserve Act

Please send to –

John Titus

9660 Falls of Neuse Rd

Suite 138, No. 241

Raleigh, NC 27615

EXTRAS

BONUS MATERIAL

Interview 1929 – John Titus Explains the War for Bankocracy

John Titus Explains the War for Bankocracy ~

The Corbett Report on February 11th, 2025

COMING UP

WATCH ALL EPISODES AS THEY ARE RELEASED