Financial Reform - Banks `Dodged a Bullet'

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

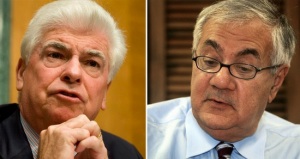

Financial Reform – Banks `Dodged a Bullet'

By Christine Harper

Legislation to overhaul financial regulation will help curb risk-taking and boost capital buffers. What it won’t do is fundamentally reshape Wall Street’s biggest banks or prevent another crisis, analysts said.

A deal reached by members of a House and Senate conference early this morning diluted provisions from the tougher Senate bill, limiting rather than prohibiting the ability of federally insured banks to trade derivatives and invest in hedge funds or private equity funds.

Banks “dodged a bullet,” said Raj Date, executive director for Cambridge Winter Inc.’s center for financial institutions policy and a former Deutsche Bank AG executive. “This has to be a net positive.”

Continue reading Banks `Dodged a Bullet’ as U.S. Congress Dilutes Trading Rules

Related reading:

Byrd’s Death Puts Financial Reform Efforts at Risk

Yahoo News (28 June 10)

Dodd-Frank Wall Street Reform and Consumer Protection Act

The Dodd-Frank Bill Up Close

The New York Times (28 JUNE 10)

Scrambling For Senate Votes on Wall Street Reform

Yahoo Finance (28 June)

Dodd-Frank Bill Complete, Bankers React

Forbes.com (25 June 10)

Strong Enough for Tough Stains?

The New York Times (25 June 10)

Biggest Banks Dodge Some Bullets at The End

The Wall Street Journal (26 June 10)

Senator’s Concern May Complicate Wall Street Bill Vote

Reuters (26 June 10)

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.