Money & Markets Report: March 16, 2023

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Money & Markets Report: March 16, 2023

A Short Preview (Login to Access the Full Interview):

Theme: Bank Run or Take Down?

Interview: Solution Series: Securing Your Privacy from Big Tech with Rob Braxman

Take Action

Please login to see stories, charts, and subscriber-only content.Not a subscriber yet? You are invited to join here!

125 Comments

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

125 Comments

-

Bills that contain this redefinition of money already passed the Kentucky Senate, the Montana Senate, the Indiana Senate, and the North Dakota House. They have breezed through the committees in every state they have been introduced. If this is not stopped, it will be the death of our freedom. Every Republican governor and legislator needs to be informed about these UCC changes and to oppose them until this provision is changed. Moreover, they need to go on offense and pass legislation explicitly promoting decentralization and prohibiting the implementation of a central bank digital currency. Time is of the essence.

-

South Dakota governor vetoed

-

Rumor on the street is they have enough votes to override the veto.

-

Ugly.

-

I think word / awareness is spreading. I have heard of some SD legis. reps who have changed their mind(s), i.e. “who didn’t read the bill”….also Mark Crispin Miller wrote a good substack yesterday on CBDC’s, and got 200+ comments.

-

-

-

Did you see the photo of the governor holding this huge veto stamp? It looked like a branding iron and left a huge red “veto” on the the paper. I had a good chuckle.

-

Yes, I saw that, also. Very theatrical!

-

-

-

-

This is a quote from the damage control communication email sent out by First Republic Bank to clients out West here as a result of it’s hit due to the antics at SVB. (Usual gang to the “rescue”.) Not sure what the new Bank Term Funding Program is about..??

“The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies, and further strengthens First Republic’s existing liquidity profile. The total available, unused liquidity to fund operations is now more than $70 billion. This excludes additional liquidity First Republic is eligible to receive under the new Bank Term Funding Program announced by the Federal Reserve today.

Jim Herbert, Founder and Executive Chairman and Mike Roffler, CEO and President of First Republic Bank said, “First Republic’s capital and liquidity positions are very strong, and its capital remains well above the regulatory threshold for well-capitalized banks.”-

Overall in the US the banks hold $600+Bn in unrealised losses.

Those will get transferred to the Fed’s balance sheet with the $600+Bn getting transferred into “money” in circulation, allegedly for one year. Then the liability will get rolled over.

The big questions is : what will interest rates look like in a year’s time and after retail real estate and commercial real estate loan problems surface?

The Fed did something very similar in 2008, when their balance sheet was much smaller.-

R-Thanks for clarifying the new scheme…BTFP.

-

@richard lough did you watch Titus’ latest Best Evidence video too? It’s interesting when you consider the Fed is raising interest rates but isn’t entering the repo market (yet) this time around…that And the issue is 10x bigger than it was in 2008. ?

-

One of the biggest reasons for a potential “train wreck”. Probably shouldn’t use that metaphor with all the literal train wrecks in the US lately….

-

-

-

-

Another big bank down today. “Who’s your banker?”

Does anyone know how long it takes to get your cash insurance payment if your bank (insured by FDIC or NCUA if credit union) goes belly up?

Also, do they require you to present a current bank statement or do they take the bank’s ledgers as of the death date and start cutting checks from the government for your amount on deposit? Yet another reason to make sure you archive your bank statements.

-

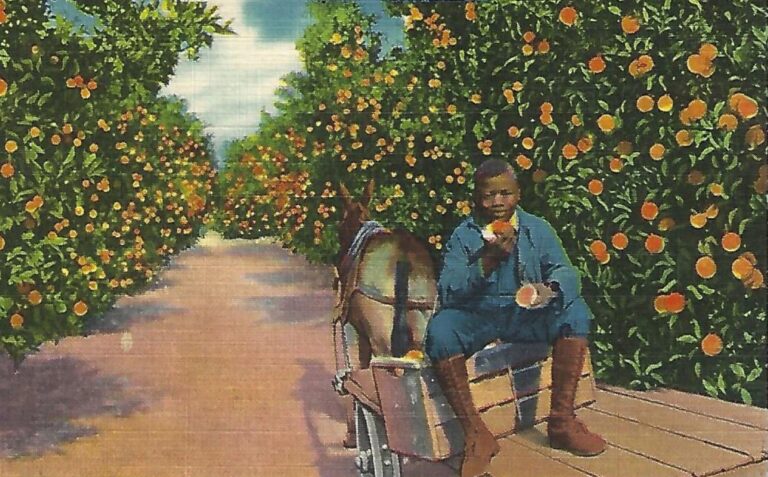

I asked a Morgan Stanley advisor today about how FDIC works. He gave me this and a 30 page document with more specifics. This image might be helpful to somebody so posting here. At least it gives you links to peruse should you want more information.

-

This looks similar for NCUA:

https://ncua.gov/files/publications/guides-manuals/NCUAHowYourAcctInsured.pdf -

Nice quick reference. Thanks for posting this.

-

-

-

SVB “bank run” narrative and meta-commentary

https://twitter.com/thetomzone/status/1635027440790810625

this thread is a wild ride, it’s like if European royalty all had a group chat in 1914 and they all started panicking so much about the security risks to Archduke Ferdinand that he had a heart attack and died

-

In the unlikely event you both missed this key detail as I did until just now: the Fed will buy assets at par, not fair value, via the BTFP.

Oh, and Becker was on the SF Fed until last week. Good thing you don’t have any emojis for us to choose from!-

Yes. Very critical decision along with the uninsured deposits.

-

https://twitter.com/popjump/status/1635092761132269569

With the backstop in place this means the Fed can raise interest rates by 50bps without harming HTM assets, since they can be traded in *at par* if banks need liquidity. This enables the Fed to go higher for longer…

https://twitter.com/paulomacro/status/1635107645907681281

Big regional top 10ish will be fine. Problem is the public is only beginning to get hip to the fact that you can buy a money market fund easily for 4%, no load. Why park balances at 0? And so balances will continue to shift from bank deposits to MMFs until banks raise rates

But since upside down banks can’t afford to jack deposit rates and now with “BTFD” Fed facilities they can borrow against HTM without having to sell and take a mark, they can meet depositor outflows but deposits will gradually drift over time to earn a yield.

the ex-10 regionals have less HTM and more CRE, ie less collateral with which to tap the BTFD window. And yes I am using that BTFD acronym incorrectly on purpose.

-

-

-

Lauterbach in Germany admits to vaccine injuries….!?

https://youtu.be/ee910ZyTxew-

Link of full show with English subtitles here: https://youtu.be/653x0SpYd48

-

Indeed. Never seen the “Health Minister” so wide-eyed and switched-on. Looks like someone sat him down and said “This better be really really good”. Unfortunately he’s still claiming less than 1 in 10,000 serious adverse effects (which even the trials shows is nonsense), and he was all over the news last Friday with this plans for digital health pass, and the press are completely supine. Oh, and he wants to start an institute to look into vaccine injuries. (I can hear Catherine laughing loudly at that idea).

Some nice person did a translation and comment:

https://www.eugyppius.com/p/karl-lauterbach-in-substantial-reversal-

The 2013 UK TV series “Utopia” (all episodes available on YT) includes a Health Dept civil servant, https://utopiatv.fandom.com/wiki/Michael_Dugdale

-

Yes that emphasis on 1 in 10,000 is him trying very hard to cover this mess which is kind of impossible.

I bet he is feeling some heat moving into ‘chew toy’ territory now! -

That’s not all: someone picked up on and did a 5-part report on Lauterbach’s (probably) faked CV (and more) and the story even made it to “Die Welt” (approx 1 day before the ZDF interview of Lauterbach, oh and 2 days earlier there was a 30 min report on “post-vacc” also by ZDF the public German broadcaster):

https://www.hintergrund.de/autor/thomas-kubo/

https://www.welt.de/politik/deutschland/plus244225919/Karl-Lauterbach-Der-dunkle-Fleck-in-seiner-Vergangenheit.html

https://www.zdf.de/nachrichten/video/corona-impfung-nebenwirkungen-impfschaden-video-100.html-

Is there a way to read the article without accepting cookies?

-

-

-

Seems rollout of calendars is being accelerated to mask atrocities. Expecting “the alien” on the white lawn pretty soon! Thank you Marlene, this video was very clarifying.

-

They’ll need a mothership or two of aliens to cover the news as more truth and details about the vaccine injuries hit mainstream.

-

-

-

And look who happens to be on the Board of Signature Bank https://investor.signatureny.com/governance/board-of-directors/default.aspx

Could it be, the very same Frank of the Dodd-Frank Wall Street and Consumer Protection Act?

Comments are closed.

https://www.theblaze.com/op-ed/horowitz-south-dakota-and-other-red-states-are-about-to-ban-bitcoin-as-legal-money-cbdc

South Dakota governor vetoed

Rumor on the street is they have enough votes to override the veto.

Ugly.

I think word / awareness is spreading. I have heard of some SD legis. reps who have changed their mind(s), i.e. “who didn’t read the bill”….also Mark Crispin Miller wrote a good substack yesterday on CBDC’s, and got 200+ comments.

Did you see the photo of the governor holding this huge veto stamp? It looked like a branding iron and left a huge red “veto” on the the paper. I had a good chuckle.

Yes, I saw that, also. Very theatrical!

This is a quote from the damage control communication email sent out by First Republic Bank to clients out West here as a result of it’s hit due to the antics at SVB. (Usual gang to the “rescue”.) Not sure what the new Bank Term Funding Program is about..??

“The additional borrowing capacity from the Federal Reserve, continued access to funding through the Federal Home Loan Bank, and ability to access additional financing through JPMorgan Chase & Co. increases, diversifies, and further strengthens First Republic’s existing liquidity profile. The total available, unused liquidity to fund operations is now more than $70 billion. This excludes additional liquidity First Republic is eligible to receive under the new Bank Term Funding Program announced by the Federal Reserve today.

Jim Herbert, Founder and Executive Chairman and Mike Roffler, CEO and President of First Republic Bank said, “First Republic’s capital and liquidity positions are very strong, and its capital remains well above the regulatory threshold for well-capitalized banks.”

Overall in the US the banks hold $600+Bn in unrealised losses.

Those will get transferred to the Fed’s balance sheet with the $600+Bn getting transferred into “money” in circulation, allegedly for one year. Then the liability will get rolled over.

The big questions is : what will interest rates look like in a year’s time and after retail real estate and commercial real estate loan problems surface?

The Fed did something very similar in 2008, when their balance sheet was much smaller.

R-Thanks for clarifying the new scheme…BTFP.

@richard lough did you watch Titus’ latest Best Evidence video too? It’s interesting when you consider the Fed is raising interest rates but isn’t entering the repo market (yet) this time around…that And the issue is 10x bigger than it was in 2008. ?

One of the biggest reasons for a potential “train wreck”. Probably shouldn’t use that metaphor with all the literal train wrecks in the US lately….

Another big bank down today. “Who’s your banker?”

Does anyone know how long it takes to get your cash insurance payment if your bank (insured by FDIC or NCUA if credit union) goes belly up?

Also, do they require you to present a current bank statement or do they take the bank’s ledgers as of the death date and start cutting checks from the government for your amount on deposit? Yet another reason to make sure you archive your bank statements.

I asked a Morgan Stanley advisor today about how FDIC works. He gave me this and a 30 page document with more specifics. This image might be helpful to somebody so posting here. At least it gives you links to peruse should you want more information.

This looks similar for NCUA:

https://ncua.gov/files/publications/guides-manuals/NCUAHowYourAcctInsured.pdf

Nice quick reference. Thanks for posting this.

SVB “bank run” narrative and meta-commentary

https://twitter.com/thetomzone/status/1635027440790810625

In the unlikely event you both missed this key detail as I did until just now: the Fed will buy assets at par, not fair value, via the BTFP.

Oh, and Becker was on the SF Fed until last week. Good thing you don’t have any emojis for us to choose from!

https://www.theblaze.com/op-ed/horowitz-with-the-impending-bank-bailout-and-stagflation-trap-its-time-to-clip-the-wings-of-the-federal-reserve#toggle-gdpr

Yes. Very critical decision along with the uninsured deposits.

https://twitter.com/popjump/status/1635092761132269569

https://twitter.com/paulomacro/status/1635107645907681281

Lauterbach in Germany admits to vaccine injuries….!?

https://youtu.be/ee910ZyTxew

Link of full show with English subtitles here: https://youtu.be/653x0SpYd48

Indeed. Never seen the “Health Minister” so wide-eyed and switched-on. Looks like someone sat him down and said “This better be really really good”. Unfortunately he’s still claiming less than 1 in 10,000 serious adverse effects (which even the trials shows is nonsense), and he was all over the news last Friday with this plans for digital health pass, and the press are completely supine. Oh, and he wants to start an institute to look into vaccine injuries. (I can hear Catherine laughing loudly at that idea).

Some nice person did a translation and comment:

https://www.eugyppius.com/p/karl-lauterbach-in-substantial-reversal

The 2013 UK TV series “Utopia” (all episodes available on YT) includes a Health Dept civil servant, https://utopiatv.fandom.com/wiki/Michael_Dugdale

Yes that emphasis on 1 in 10,000 is him trying very hard to cover this mess which is kind of impossible.

I bet he is feeling some heat moving into ‘chew toy’ territory now!

That’s not all: someone picked up on and did a 5-part report on Lauterbach’s (probably) faked CV (and more) and the story even made it to “Die Welt” (approx 1 day before the ZDF interview of Lauterbach, oh and 2 days earlier there was a 30 min report on “post-vacc” also by ZDF the public German broadcaster):

https://www.hintergrund.de/autor/thomas-kubo/

https://www.welt.de/politik/deutschland/plus244225919/Karl-Lauterbach-Der-dunkle-Fleck-in-seiner-Vergangenheit.html

https://www.zdf.de/nachrichten/video/corona-impfung-nebenwirkungen-impfschaden-video-100.html

Is there a way to read the article without accepting cookies?

Seems rollout of calendars is being accelerated to mask atrocities. Expecting “the alien” on the white lawn pretty soon! Thank you Marlene, this video was very clarifying.

They’ll need a mothership or two of aliens to cover the news as more truth and details about the vaccine injuries hit mainstream.

And look who happens to be on the Board of Signature Bank https://investor.signatureny.com/governance/board-of-directors/default.aspx

Could it be, the very same Frank of the Dodd-Frank Wall Street and Consumer Protection Act?