NYSE Margin Rises Sharply

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

NYSE Margin Rises Sharply

By Mark Lundeen

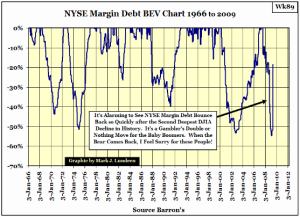

The NYSE published weekly Margin Debt (NYSE MD) numbers from the 1920s to 1965. Starting in 1966, they switched to a monthly basis. The change in data is clearly evident in the BEV Chart below. NYSE Margin Debt are loans made by brokerages to retail customers for the purpose of leveraging positions. If someone has $10,000, but wants to purchase $20,000 of a stock, they can do this with the use of margin debt. Buying your stocks with someone else’s money can double gains, * and losses * in a hurry.

The numbers for May 2009, NYSE MD’s came out last week in Barron’s. I found the increase in retail investor’s leverage alarming.

As with any financial series concerning debt or money, we can see how monetary inflation has increased since 1926. What’s amazing about this chart is the abrupt U-Turn NYSE MD has taken since April 2009. NYSE MD has increased 79% from its lows of February!

Continue Reading Mark Lundeen’s Bear Market Race to the Bottom

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.