The Mortgage Bear Growls

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

The Mortgage Bear Growls

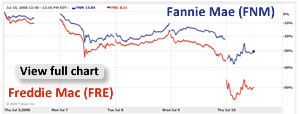

Fannie and Freddie are down this morning:

One consensus is emerging on line that the Fed is to blame for mortgage market woes:

Who Killed the Economy? – At Portfolio.com (24 Jun 2008)

The response of the Fed and the Secretary of the Treasury, the former Chairman of Goldman Sachs a leading member and presumed shareholder of the NY Fed, is to propose the Fed be given even more power:

Bernanke, Paulson Push for New Regulatory Powers

By Brian Blackstone & Michael Crittenden – Wall Street Journal (10 Jul 2008)

One possibility is to recapture the $4 trillion and gold missing from federal accounts to stabilize and replenish communities and pension funds drained by federal mortgage policies.

The Bell Tolls for the Bubble

By Catherine Austin Fitts – Solari (8 Jul 2008)

2 Comments

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

2 Comments

-

Scary stuff.

Although not surprising, given that you’ve predicted this for a long time.

I’m reminded of a prophetic book I actually read before buying my first house:

http://www.amazon.com/Coming-Crash-Housing-Market-Investment/dp/007142220X

The book outlined in detail exactly how everything would fall apart, and here it goes.Thought you might also enjoy the consumerist.com version of the stock chart:

http://consumerist.com/tag/too-big-to-fail/?i=5023841&t=mortgages-of-the-apocalypse-are-freddie-and-fannie-going-to-collapse -

Catherine,

Is not the federal reserve at the helm of all this centralization, inflating/devaluing the dollar

with money/credit expansion and enabling all the other actors like Freddie Mae to compound it all

or is this oversimplifying?After all having a central bank is the antithesis of a free market.

Comments are closed.

Scary stuff.

Although not surprising, given that you’ve predicted this for a long time.

I’m reminded of a prophetic book I actually read before buying my first house:

http://www.amazon.com/Coming-Crash-Housing-Market-Investment/dp/007142220X

The book outlined in detail exactly how everything would fall apart, and here it goes.

Thought you might also enjoy the consumerist.com version of the stock chart:

http://consumerist.com/tag/too-big-to-fail/?i=5023841&t=mortgages-of-the-apocalypse-are-freddie-and-fannie-going-to-collapse

Catherine,

Is not the federal reserve at the helm of all this centralization, inflating/devaluing the dollar

with money/credit expansion and enabling all the other actors like Freddie Mae to compound it all

or is this oversimplifying?

After all having a central bank is the antithesis of a free market.