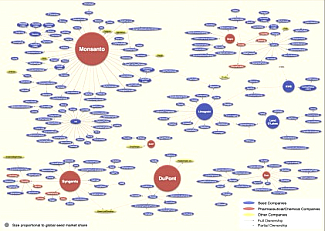

Visualizing Consolidation in the Global Seed Industry - 1996-2008

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Visualizing Consolidation in the Global Seed Industry – 1996-2008

By Phil Howard

In the last 40 years, the commercial seed industry has transformed dramatically. It has shifted from a competitive sector of agribusiness, composed primarily of small, family-owned firms, to an industry dominated by a small number of transnational pharmaceutical/chemical corporations. These corporations entered the industry by acquiring numerous smaller seed companies, and merging with large competitors. This consolidation is associated with a number of impacts that constrain the opportunities for renewable agriculture. Some of these include declining rates of saving and replanting seeds, as firms successfully convince a growing percentage of farmers to purchase their products year after year; a shift in both public and private research toward the most profitable proprietary crops and varieties, but away from the improvement of varieties that farmers can easily replant; and a reduction in seed diversity, as remaining firms eliminate less profitable lines from newly acquired subsidiaries.

(for a larger image, go HERE))

(for a larger image, go HERE))

Continue reading the article . . .

Related reading:

Why is the Gates foundation investing in GM giant Monsanto?

The Guardian (29 Sep 10)

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.