Money & Markets ~ Charts 4.30.09

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Money & Markets ~ Charts 4.30.09

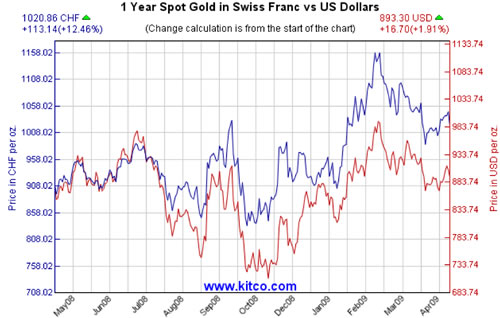

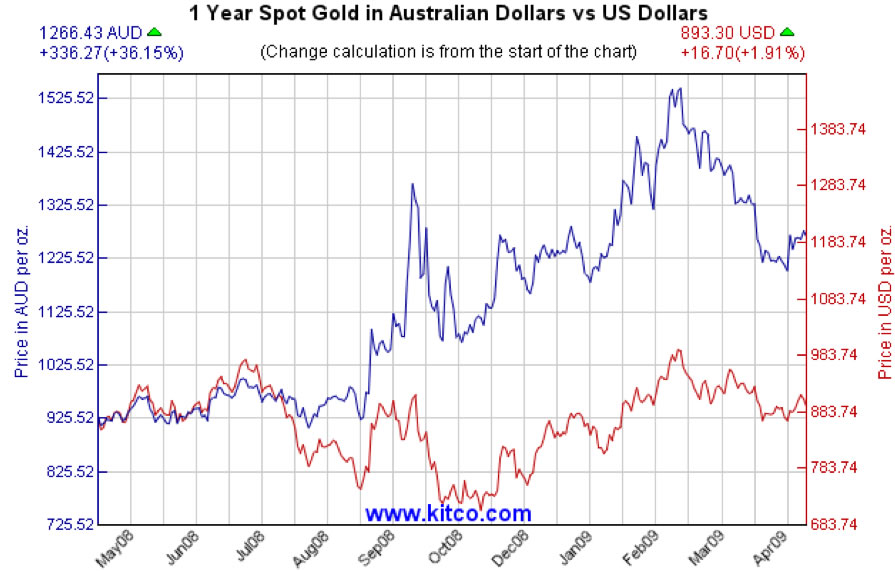

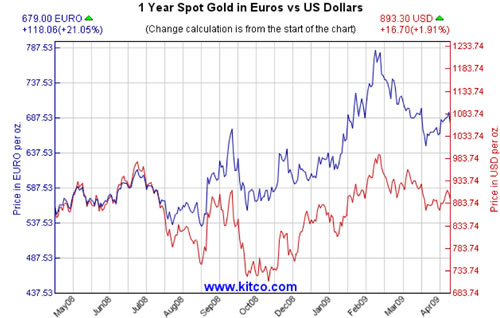

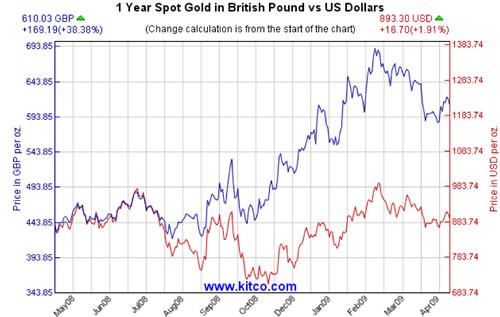

View this week’s chart comparisons of gold against fiat currencies, oil and the Dow for the Money & Markets segment of The Solari Report next Thursday, May 7, 2009.

Click here to view all charts as a pdf file.

Previous Money & Markets blog posts: Apr 23, Apr 16, Apr 9, Apr 2, Mar 27, Mar 12.

Currency charts are from Kitco.com, all others are from StockCharts.com.

Click here to view all charts as a pdf file.

2 Comments

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

2 Comments

-

From Jesse’s crossroads cafe, http://jessescrossroadscafe.blogspot.com/

Scroll down to Silver first notice day,

Comex May silver Open Interest as of yesterday’s close was 4365. I don’t think this includes the old CME contract, which is the NYSE Liffe contract, so this number ultimately may be low.

These 4365 contracts equate to 21.8 million ounces, or 33% of the amount of silver on the Comex that is registered for delivery. Not enough to do real damage to the Comex inventory, but probably enough raise some eyebrows around the world. I am absolutely convinced that part of this week’s pure paper attack on silver was designed to discourage longs from taking delivery.”

The silver market has been manipulated for some time now based on what we have seen. Interestingly enough one of the principle players had been the London crew of AIG, who apparently had to find a new routine when AIG exited that trade a few years ago. What was an insurance company doing as a major trading player in the metals markets? Because they had not yet discovered the benefits of selling increasingly worthless derivatives.

If this is true, if these markets are being used in this way, then we should see increasing shortages of the physical products until the exchange delivery mechanism is broken, and the contracts force settled in cash, with defaults in funds galore.

The investigation into the metals and energy markets by the CFTC and other government agencies makes the SEC appear to have the wisdom and integrity of Solomon.

-

Harral:

Great post. Thanks!

Catherine

Comments are closed.

From Jesse’s crossroads cafe, http://jessescrossroadscafe.blogspot.com/

Scroll down to Silver first notice day,

Comex May silver Open Interest as of yesterday’s close was 4365. I don’t think this includes the old CME contract, which is the NYSE Liffe contract, so this number ultimately may be low.

These 4365 contracts equate to 21.8 million ounces, or 33% of the amount of silver on the Comex that is registered for delivery. Not enough to do real damage to the Comex inventory, but probably enough raise some eyebrows around the world. I am absolutely convinced that part of this week’s pure paper attack on silver was designed to discourage longs from taking delivery.”

The silver market has been manipulated for some time now based on what we have seen. Interestingly enough one of the principle players had been the London crew of AIG, who apparently had to find a new routine when AIG exited that trade a few years ago. What was an insurance company doing as a major trading player in the metals markets? Because they had not yet discovered the benefits of selling increasingly worthless derivatives.

If this is true, if these markets are being used in this way, then we should see increasing shortages of the physical products until the exchange delivery mechanism is broken, and the contracts force settled in cash, with defaults in funds galore.

The investigation into the metals and energy markets by the CFTC and other government agencies makes the SEC appear to have the wisdom and integrity of Solomon.

Harral:

Great post. Thanks!

Catherine