Dominant and Dangerous

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

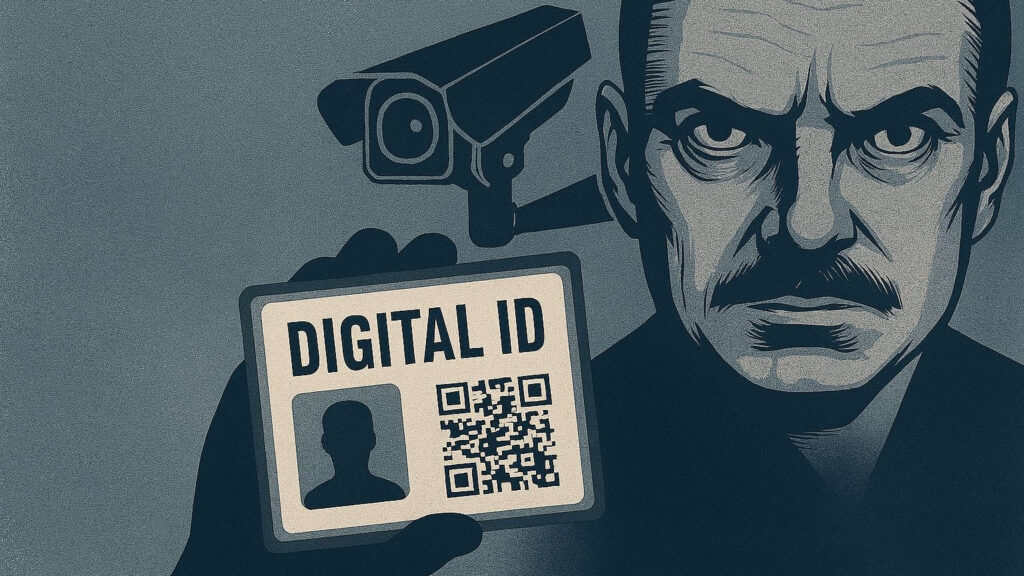

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Dominant and Dangerous

As America’s economic supremacy fades, the primacy of the dollar looks unsustainable

IF HEGEMONS are good for anything, it is for conferring stability on the systems they dominate. For 70 years the dollar has been the superpower of the financial and monetary system. Despite talk of the yuan’s rise, the primacy of the greenback is unchallenged. As a means of payment, a store of value and a reserve asset, nothing can touch it. Yet the dollar’s rule has brittle foundations, and the system it underpins is unstable. Worse, the alternative reserve currencies are flawed. A transition to a more secure order will be devilishly hard.

When the buck stops

For decades, America’s economic might legitimised the dollar’s claims to reign supreme. But, as our special report this week explains, a faultline has opened between America’s economic clout and its financial muscle. The United States accounts for 23% of global GDP and 12% of merchandise trade. Yet about 60% of the world’s output, and a similar share of the planet’s people, lie within a de facto dollar zone, in which currencies are pegged to the dollar or move in some sympathy with it. American firms’ share of the stock of international corporate investment has fallen from 39% in 1999 to 24% today. But Wall Street sets the rhythm of markets globally more than it ever did. American fund managers run 55% of the world’s assets under management, up from 44% a decade ago.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.