Equity Overview with Chuck Gibson, Emerging Markets 101

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Equity Overview with Chuck Gibson, Emerging Markets 101

Read the Transcript

Read the transcript of Equity Overview with Chuck Gibson, Emerging Markets 101 here PDF

Watch the Money & Markets Video

Watch the Interview Video

Listen to the Money & Markets MP3 audio file

The Solari Report 2013-10-24

Listen to the Interview MP3 audio file

The Solari Report 2013-10-24

Listen to the Complete MP3 audio file

The Solari Report 2013-10-24

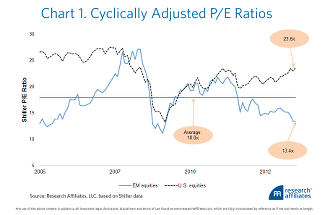

Subscriber Resources: Equity Markets 101 Charts

“Emerging markets are hugely important.” ~James Dyson

By Catherine Austin Fitts

The re-balancing of the global economy which began in the mid-1990’s fueled significant growth of the emerging markets. And this growth has resulted in increased float of emerging market securities throughout global markets.

Emerging market equities – along with corporate and sovereign bonds – now represent a significant percentage of U.S. and European pension fund, institutional and retail holdings.

The years 2008 to 2009 were a painful period for financial markets and the emerging markets were no exception. From 2010 to 2012, these markets saw improvement along with developed equity markets. But, the emerging markets have lagged significantly behind North American markets during 2013.

Why? Does this divergence represent an opportunity for investors or are there greater risks ahead? What are the primary trends?

This week, I will be speaking with Chuck Gibson – managing member of Financial Perspectives and my partner at Sea Lane Advisory, LLC – about the global emerging markets. Chuck has prepared an excellent presentation rich with analytics and charts that provide an invaluable overview for this week’s Solari Report.

In the Money & Markets segment, join me for a discussion of current events including the repercussions of the U.S. fiscal squabbles.

In Let’s Go to the Movies, I will review Stock Shock, a fascinating documentary about the early years of Sirius XM radio that is a reminder of the many things that can (and do) go wrong with equity investments, particularly with early-stage companies.

I hope you’ll join us this week on the Solari Report!

6 Comments

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

6 Comments

-

Hi Catherine,

A few months back, one of your subscribers asked about Karen Hudes. Gary Null had her on the Progressive Commentary Hour this week. I think your assessment of her was correct because her information was rather pathetic and she really didn’t tell anything new, typical of your Limited Hangout. It was an unpleasant interview, even Gary was frustrated and I think he cut her early since she only repeated herself about how much she was doing as a whistle blower.

Good call.

Tony-

Hi Catherine,

Thanks for sharing. What was really remarkable about that interview was when Gary asked her about the recent piece by Greg Palast and the Larry Summers secret memo. She never heard of Greg Palast was her reply. Gary read it to her including that it had been confirmed by several means. She then dismissed it because he works for the BBC and that she took her information to them and they wouldn’t take it and on and on. She then claimed to have confronted Larry when they were at a PTA meeting together. That segment really gave me a laugh.

Webster Tarpley did an excellent piece on Limited Hangouts early in the summer.

http://www.presstv.ir/detail/2013/06/18/309609/how-to-identify-cia-limited-hangout-op/Tony

-

-

Sorry but I just do not see WHERE we are supposed to find Charts for this presentation.

-

Amazing that Chuck should comment on emerging markets turning towards domestic production. Mirrors comments by Dr. David Martin at the closing of BEM 2013 in that China is turned/turning to produce for a rising middle class and NOT to be a world exporter.

Further I was SO AMAZED to here that China some time back had written down their U.S. dollars to 0.70 and David Martin pointed out that not only did the markets fail to rush in and offer 0.80 for whatever the Chinese would sell but they are contemplating writing down their holdings another 0.20 to FIFTY CENTS on the dollar. So they themselves consider their american holdings are 3 trillion instead of 6 trillion…where was THAT in the news. -

Richard:

China will be building consumer markets. That point aside, I disagree strongly with Martin’s description of events. I will talk about it in Ask Catherine if you like.

The charts are at the bottom of the blog post in the Subscriber Resources section. Can you see them?

Catherine

-

Ditto. I had found it yesterday but cannot find it today. Sorry but I just do not see WHERE we are supposed to find Charts for this presentation.

Comments are closed.

Hi Catherine,

A few months back, one of your subscribers asked about Karen Hudes. Gary Null had her on the Progressive Commentary Hour this week. I think your assessment of her was correct because her information was rather pathetic and she really didn’t tell anything new, typical of your Limited Hangout. It was an unpleasant interview, even Gary was frustrated and I think he cut her early since she only repeated herself about how much she was doing as a whistle blower.

Good call.

Tony

Hi Catherine,

Thanks for sharing. What was really remarkable about that interview was when Gary asked her about the recent piece by Greg Palast and the Larry Summers secret memo. She never heard of Greg Palast was her reply. Gary read it to her including that it had been confirmed by several means. She then dismissed it because he works for the BBC and that she took her information to them and they wouldn’t take it and on and on. She then claimed to have confronted Larry when they were at a PTA meeting together. That segment really gave me a laugh.

Webster Tarpley did an excellent piece on Limited Hangouts early in the summer.

http://www.presstv.ir/detail/2013/06/18/309609/how-to-identify-cia-limited-hangout-op/

Tony

Sorry but I just do not see WHERE we are supposed to find Charts for this presentation.

Amazing that Chuck should comment on emerging markets turning towards domestic production. Mirrors comments by Dr. David Martin at the closing of BEM 2013 in that China is turned/turning to produce for a rising middle class and NOT to be a world exporter.

Further I was SO AMAZED to here that China some time back had written down their U.S. dollars to 0.70 and David Martin pointed out that not only did the markets fail to rush in and offer 0.80 for whatever the Chinese would sell but they are contemplating writing down their holdings another 0.20 to FIFTY CENTS on the dollar. So they themselves consider their american holdings are 3 trillion instead of 6 trillion…where was THAT in the news.

Richard:

China will be building consumer markets. That point aside, I disagree strongly with Martin’s description of events. I will talk about it in Ask Catherine if you like.

The charts are at the bottom of the blog post in the Subscriber Resources section. Can you see them?

Catherine

Ditto. I had found it yesterday but cannot find it today. Sorry but I just do not see WHERE we are supposed to find Charts for this presentation.