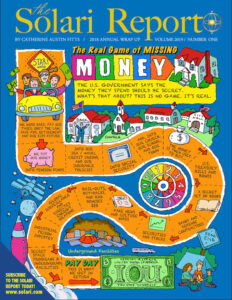

2. Missing Money

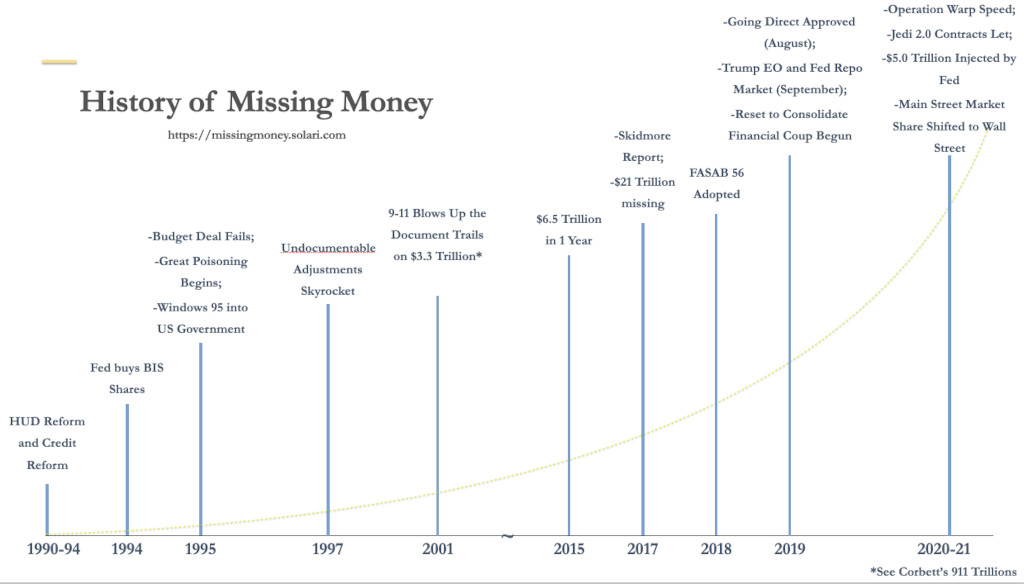

I. FASAB 56 & Missing Money:

$21 Trillion Missing Money Song

9/10/2001 – Donald Rumsfeld, $2.3 Trillion Missing

Legal Series – US Monetary and Fiscal Operations

We present our series of Solari Special Reports on legal aspects of US fiscal and monetary policy by Michele Ferri & Jonathan Lurie.

- The Appropriations Clause: A History of the Constitution’s (As of Yet) Underused Clause

- The U.S. Statutes Creating Modern Constitutional Financial Management and Reporting Requirements and the Government’s Failure to Follow Them

- The Black Budget: The Crossroads of (Un)Constitutional Appropriations and Reporting

- FASAB Statement 56: Understanding New Government Financial Accounting Loopholes

- National Security Exemptions and SEC Rule 10b-5

- Classification for Investors 101

- The History and Organization of the Federal Reserve: The What and Why of the United States’ Most Powerful Banking Organization

FASAB 56 & Missing Money Headlines

Other Solari Resources:

- Dr. Mark Skidmore & Catherine Austin Fitts Discuss $21 Trillion

- Navigating Reality with Dr. Mark Skidmore

- Update on the Missing Money with Dr. Mark Skidmore

- The Financial Coup: More Missing Money & FASAB Standard 56 with Dr. Mark Skidmore

- $21+ Trillion of Your Money Is Missing: Is It Financing the Control Grid?

- The Iron Bank: Is BIS Sovereign Immunity the Secret Sauce Behind the Global Coup? Part I with Patrick Wood

- The Iron Bank: Is BIS Sovereign Immunity the Secret Sauce Behind the Global Coup? Part II with Patrick Wood

- The Many Faces of Secrecy with Amy Benjamin

- Catherine Austin Fitts on Dark Journalist: Missing Trillions & the Secret Space Force Economy

- Book Review: Tower of Basel: The Shadowy History of the Secret Bank that Runs the World by Adam Lebor

- Pushback of the Week: March 3, 2025: Congressman Tim Burchett on the Pentagon’s Failed Audits

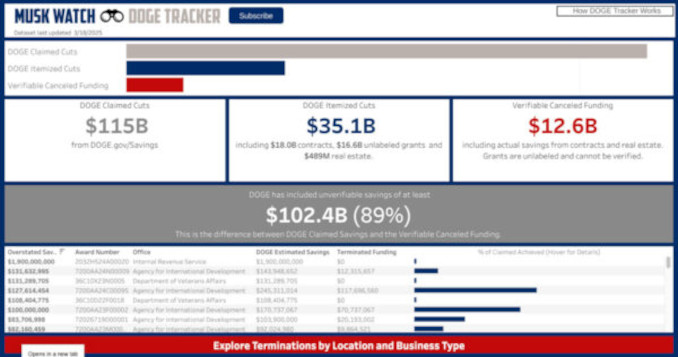

II. DOGE Takes a Pass:

SEC Still Takes a Pass:

Headlines:

- The SEC Is Suing Elon Musk. It’s All in the Timing

- SEC FY 2024 Enforcement Nabs Highest in Agency History, But…

SEC Still Takes a Pass Headlines

Resource: U.S. Securities and Exchange Commission

IV. U.S. Treasury Market:

Headlines:

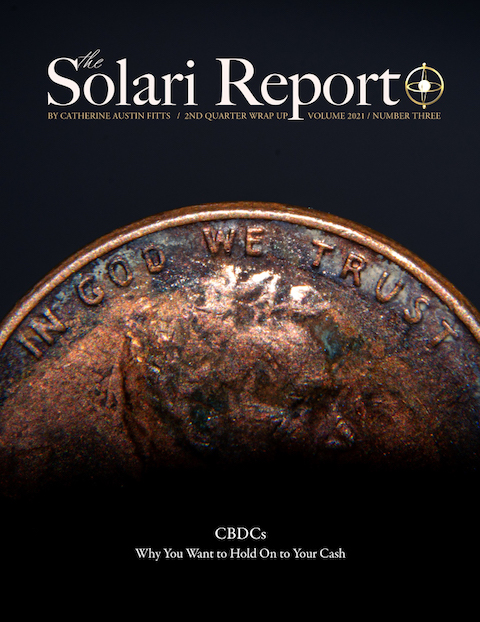

- Stablecoins vs CBDC — US and EU Are on Different Paths to the Same Destination: Programmable Money

- So Many Americans Died From COVID, It’s Boosting Social Security to the Tune of $205 Billion

- Hagerty Releases Discussion Draft of Comprehensive Stablecoin Legislation

- Bank of America’s CEO Says Stablecoins Are Coming Very Soon

- Photos and Documents From Secretary Mnuchin’s Fort Knox Trip Released

- DOGE Wants To Audit Fort Knox Gold

U.S. Treasury Market Headlines

Other Solari Resources:

Caveat Emptor: Why Investors Need to Do Due Diligence on U.S. Treasury

and Related Securities

I. INTRODUCTION

Investors have experienced challenging times since the change in U.S. Presidential administrations in 2017 initiated a period of reverse globalization with continuous changes in tax, trade, and other U.S. federal policies. Unnoticed in the fray is the October 2018 adoption by the U.S. Congress and Administration of an obscure federal accounting policy that signifies the most important change in the balance of power between the public and private sectors, between overt and covert operations, and between the democratic and fascistic aspects of the American political system: Federal Accounting Standards Advisory Board Statement of Financial Standards 56 (“FASAB 56” or “Statement 56”). In simple terms, FASAB 56 claims to override the last 230 years of U.S. Constitution and….

Part I-2: Top Stories & Videos

1. Trump: The First 70 Days

3. Control Grid