The Solari Papers #2: U.S. State Bullion Depositories

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

The Papers

$21 Trillion Missing

- Missing Money 2021 Update

- Missing Money 2020 Update

- Thrift Savings Fund—Treasury Account 026×61531

- FASAB Standard 56 and the Authority of the Director of National Intelligence to Waive SEC Financial Reporting

News Coverage

Video Page

Case Studies

Space: The New Frontier For The Central Control Grid

Legal Series – US Monetary and Fiscal Operations

- he Appropriations Clause: A History of the Constitution’s (As of Yet) Underused Clause

- The U.S. Statutes Creating Modern Constitutional Financial Management and Reporting Requirements and the Government’s Failure to Follow Them

- The Black Budget: The Crossroads of (Un)Constitutional Appropriations and Reporting

- FASAB Statement 56: Understanding New Government Financial Accounting Loopholes

- National Security Exemptions and SEC Rule 10b-5

- Classification for Investors 101

- The History and Organization of the Federal Reserve: The What and Why of the United States’ Most Powerful Banking Organization

FASAB Statement 56

Missing Money Chronology

#my212020 & #constantamazement

The Real Game of Missing Money

- FASAB Standard 56 and the Authority of the Director of National Intelligence to Waive SEC Financial Reporting

- Should We Care about Secrecy in Financial Reporting?

- Reports on “Unsupported Journal Voucher Adjustments” for DOD & HUD

- Contractors, Investors, and Dealers

- Missing Money: A Personal History – 1989 to 2019

- Coming Clean Beyond the Fiscal Cliff

The Financial Coup & Missing Money: Quotes

Caveat Emptor

Dillon Read

Lighthouse Economics

The Solari Papers #2: U.S. State Bullion Depositories

“Americans are not a perfect people, but we are called to a perfect mission.”

~ Andrew Jackson

By Catherine Austin Fitts

A state bullion depository provides a state and its residents with a secure, in-state location to store gold and silver. The goal is to improve financial resiliency in a manner that protects the sovereign powers of the state and its residents by providing or supporting:

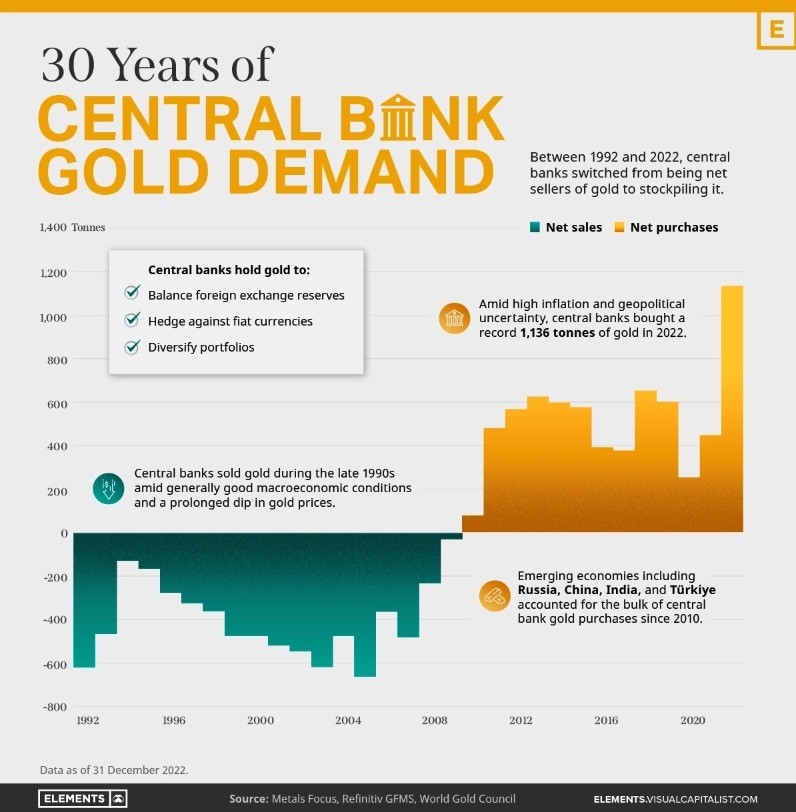

- A reliable way to own gold and silver as a hedge against deterioration of the global market share and/or inflation resulting from debasement of the U.S. dollar

- Transaction alternatives that protect against efforts to centralize control of financial transactions by banks and private parties outside of the state’s jurisdiction, including through such mechanisms as central bank digital currencies (CBDCs) and Fast Payment systems

- A secure in-state custodian that can make it easier for residents to use their gold and silver in daily transactions

The purpose of this paper is to address issues related to integrity of operations, including, importantly, those involving private parties. The goal of achieving such integrity is to ensure that the depository enhances, rather than compromises, state sovereignty and financial resiliency.

Related Reading:

Financial Transaction Freedom: What is it, what threatens it, and how do I take action to secure it?

The Future of Financial Freedom

3 Comments

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

3 Comments

-

Define “Central Banks” Please

-

-

My name for it is Wickedpedia. I always just understood that Central Banks were the creatures of International Bankster families with a license to create currencies out of thin air for the practice of usury — exactly what the prophet Ezekiel preached against—— likened to murder and adultery— And then when folks were loaded up with too much debt, they took away the money supply, and grabbed all they could steal of value from their debtors when they couldn’t pay it back with interest. 😝. The pdf is great!! I have already been talking to my bank, and will print this out to give to our State Senator and Representative.

Comments are closed.

Define “Central Banks” Please

https://en.wikipedia.org/wiki/Central_bank

My name for it is Wickedpedia. I always just understood that Central Banks were the creatures of International Bankster families with a license to create currencies out of thin air for the practice of usury — exactly what the prophet Ezekiel preached against—— likened to murder and adultery— And then when folks were loaded up with too much debt, they took away the money supply, and grabbed all they could steal of value from their debtors when they couldn’t pay it back with interest. 😝. The pdf is great!! I have already been talking to my bank, and will print this out to give to our State Senator and Representative.