By Catherine Austin Fitts

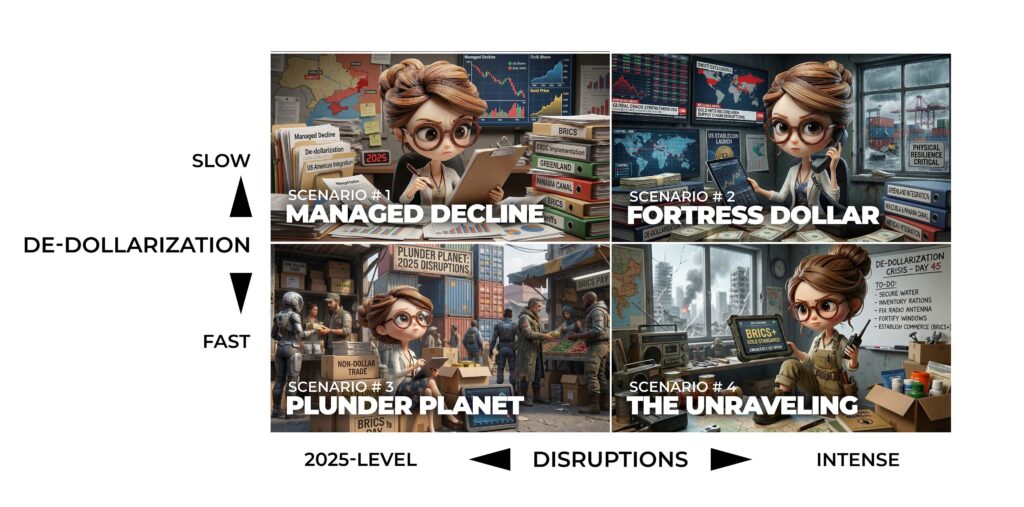

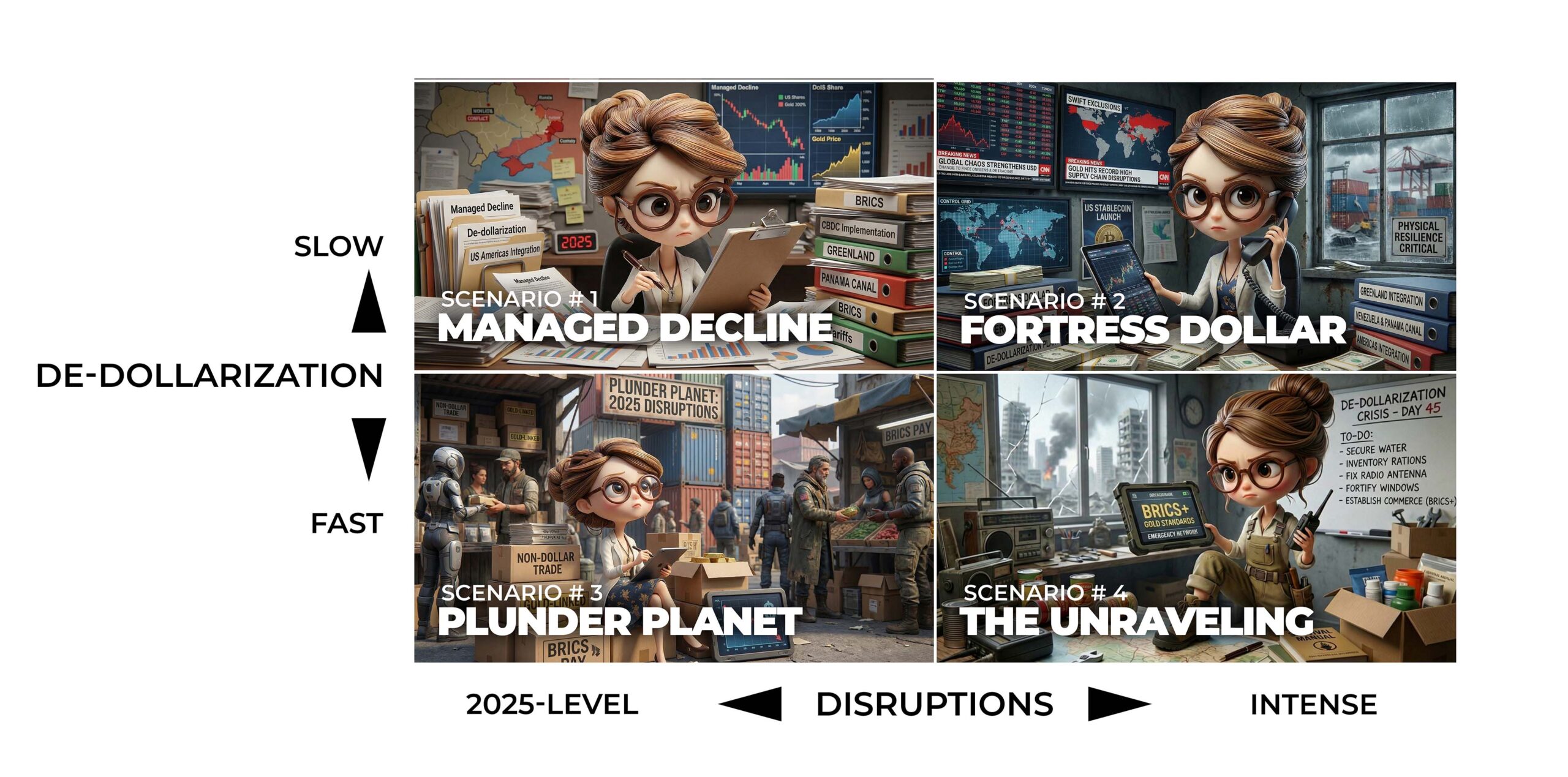

The Solari Report’s four scenarios for 2026 are based on two variables: the pace of de-dollarization (slow to fast) and the intensity of violent disruptions (maintaining 2025 levels to intense acceleration).

- De-dollarization reflects the U.S. dollar’s market share in central bank reserves, in debt and currency markets, and in trade, including oil and gas contracts.

- Violent disruptions include man-made disruptions—including conventional warfare, hybrid warfare, weather warfare (such as some floods, fires, and hurricanes), covert operations (including false flags), and organized crime—as well as natural physical disruptions, including natural disasters and geophysical events.

Four scenarios result from the intersection of slow or fast de-dollarization and 2025-level or intense violent disruptions: Managed Decline (Scenario #1), Fortress Dollar (Scenario #2), Plunder Planet (Scenario #3), and The Unraveling (Scenario #4).

For a description of each scenario as well as a list of “wild cards” that could trigger rapid shifts in scenarios, continue reading HERE.