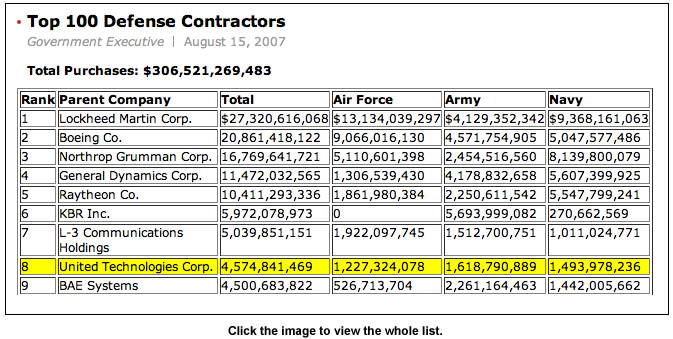

This weekend, mega defense contractor United Technologies announced an offer for Diebold (1) (2) at a 66% premium to the current stock market price. Leading this effort is the board of directors of United Technologies. United Technologies board includes Jamie Gorelick, partner at WilmerHale, who was the former Deputy Attorney General in the Clinton Administration who played such a significant role in promoting prison privatization and was a member of the 911 Commission.

This weekend, mega defense contractor United Technologies announced an offer for Diebold (1) (2) at a 66% premium to the current stock market price. Leading this effort is the board of directors of United Technologies. United Technologies board includes Jamie Gorelick, partner at WilmerHale, who was the former Deputy Attorney General in the Clinton Administration who played such a significant role in promoting prison privatization and was a member of the 911 Commission.

Gorelick is a large contributor to Hillary Clinton’s presidential campaign. Her firm, WilmerHale, is a large backer of the Clinton campaign. Not surprisingly, Gorelick is mentioned as a likely Attorney General in a Hillary Clinton Administration. In its February 2008 Proxy, United Technologies described its lead investor as follows:

Gorelick is a large contributor to Hillary Clinton’s presidential campaign. Her firm, WilmerHale, is a large backer of the Clinton campaign. Not surprisingly, Gorelick is mentioned as a likely Attorney General in a Hillary Clinton Administration. In its February 2008 Proxy, United Technologies described its lead investor as follows:

In a filing made with the SEC, State Street Bank & Trust Company, acting in various fiduciary capacities, reported that it held as of December 31, 2007 sole voting power with respect to 37,348,324 shares of UTC Common Stock, shared voting power with respect to 65,761,775 shares of UTC Common Stock, and shared dispositive power with respect to 103,110,099 shares of UTC Common Stock. State Street Bank & Trust Company serves as Trustee for UTC’s Employee Savings Plan and disclaims beneficial ownership of the reported shares.

Hence, it is hard to determine who exactly will control a significant percentage of the voting machines during the upcoming Presidential election. Question is, what does offering a $14 per share premium in a down stock market to the people who control Diebold have to do with Tuesday’s vote counting in Texas, Ohio, Rhode Island, and Vermont?

Hence, it is hard to determine who exactly will control a significant percentage of the voting machines during the upcoming Presidential election. Question is, what does offering a $14 per share premium in a down stock market to the people who control Diebold have to do with Tuesday’s vote counting in Texas, Ohio, Rhode Island, and Vermont?

Is Hillary Clinton suddenly back in the race?

Whatever happens Tuesday, my bet is UT will be positioned to win lots of new sales and contracts from the Pentagon in the new Administration. What do you think? Is owning the voting machines a government contractor’s most creative marketing strategy? If it is, Diebold has now indicated they want more than $14 per share:

Diebold Rejects United Tech Takeover Offer As Too Low

By Reuters (3 Mar 2008)

The Onion | 05 Feb 2019

Hi all!

As newly registered user i only want to say hello to everyone else who uses this forum 🙂

Hey guys and girls!

I’m a newbie here.

So i’d like to know if someone of you or your frineds was fired because of a financial crisis?

Hallo! Is there anybody here to tell me how much time have we got left till the end of the lesson?

Never underestimate the power of the internet. An increasing number of people use the internet

to search for a business or service so having a web presence is an important media for promoting

your company. Web design is a real skill and if your website is to not only look good but work well,

it should be constructed by a professional web designer.

If you are interested, you can contact me: hqwebdesign (AT) gmail (DOT) com

Greetings All

I’d just like to say that this place is awesome

I am going to be honest with you guys. This thread is nothing but a shameless promotion for my new line of Awesome T Shirts. I am one of the owners of Awesome Shirts which has recently launched in the past week. I let you know about the awesome t shirts we have on offer.

http://awesomeshirts.com.au/images/shirts/awesomefaceshirt.png

We have various designs including shirts with the Awesome Face smiley, The Game (sorry everyone but you just lost the game), a shirt dedicated to Awesomeness which is inspired by and displays a quote from How I Met Your Mother (When I get sad, I stop being sad and be Awesome instead. True Story) and a shirt concerning the newest craze, the LOL face. We are looking to expand our range in the coming weeks so keep an eye on our blog.

We are based in Australia, however we have no problems shipping our awesome t shirts internationally. Visit Awesome Shirts and display your Awesomeness to the world. Be Awesome!

Please post here and discuss the designs or leave feedback and suggestions.

Thanks,

Hi, I just became a part of this forum here and I would love to be a part of it. Seriously, love the contribution of the community.

Handmade soap blog

[b]Create a Home Business-(Online Auctions-Buy to Resell)[/b]

I love $1 dollar auctions and I am happy quite a few have sprang up lately on the net. The latest one is: http://www.webauctionsdaily.com. There are cheap auctions on Web Auctions Daily that you can buy to resell on eBay! or other auction sites and make a good profit. There are so many things including cell-phones, Jewelry, watches, electronics, Antiques, baby stuff, camera, clothing, shoes, computers, coins and even websites that sell for as little as 99c that you can go on to sell for up to $20. It might not sound like a lot of money but if you get lets say 20 items and sell them for $15-20 a piece you will make a decent amount of money. You would have to look around and do a bit of homework yourself to find items that you could resell. From time to time I do buy a few things now and then from this site and sell them on eBay! at a profit. People may not be sure whether or not they are making a profit or not on eBay! I was the same when I first started selling items. I came across this eBay Profit Calculator which made it even easier for me to calculate what kind of a profit I was making.

For those interested in posting classified ads, the forum section of Web Auctions Daily is where to go: http://www.webauctionsdaily.com/forums. At the Forums, you can place your free classified Adverts, but remember that after posting your Adverts, you have to take a moment to view some of your fellow member’s ads.