Financial Perspectives - Sept 9, 2013

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Financial Perspectives – Sept 9, 2013

By Chuck Gibson

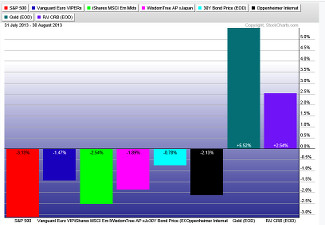

With the month of August wrapping up last week, I wanted to do a quick check back in on how different segments of the investment markets fared (reflected in the chart below). The main backdrop for most of August’s price movement was the potential FED tapering back on its bond purchases. Stock investors concerned the punchbowl may soon be pulled, began an early repositioning and lightened up on their holdings. Bond holders became afraid of the same outcome but for different reasons they sold off holdings driving interest rates to 2 year highs. Finally commodities seemed to have caught a bid (from where i sit it seems like it may not necessarily be the end of the 2 year downtrend) as investors began to look for a home for their freshly printed bond and stock sale proceeds.

From right to left – US based SP500 stock index (red), European stock index (blue), Emerging markets stock index (light green), Asian stock index (magenta), US 30yr bond (light blue), International Bonds (black), Gold (teal), Commodities (purple).

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.