Financial Perspectives - Jan. 27, 2014

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Financial Perspectives – Jan. 27, 2014

By Chuck Gibson

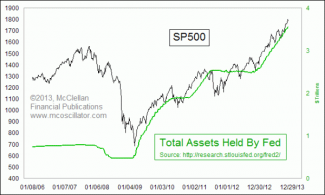

At the start of every year I like to take the time and sketch out a game plan for the year. Part of that includes identifying major areas of risk and creating a mental game plan on how to respond. Two weeks ago, I identified interest rates as being one of my major concerns. When I speak of interest rates I am really speaking of the FED as their open market operations add or subtract to the economic liquidity which helps set interest rates. Its this liquidity (either too much or little) not only has the effect they desire by controlling interest rates but an unintended consequence is its indirect effect on the prices of other assets, such as stocks. So when I hear the FED is reducing liquidity I become concerned as this move in the past has been the catalyst for a market correction. An article from one the Fathers of technical analysis, Tom Mclellan, came across my inbox recently where he does a wonderful job at capturing this relationship and I thought it worthy of presenting its highlights.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.