Ten Years in the European Union: Germany is the Winner

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Ten Years in the European Union: Germany is the Winner

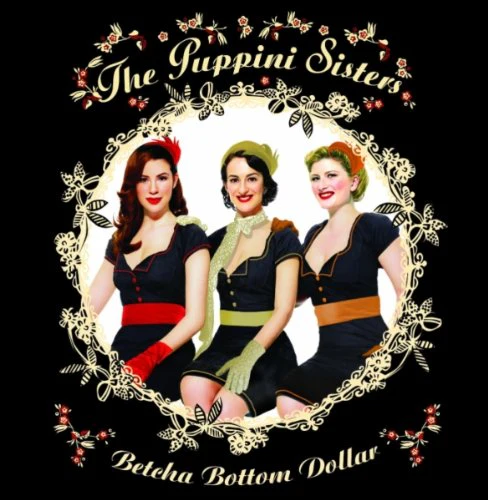

Click on the image for a larger version

“So much money is now in circulation that you can tackle whole countries with it.” ~ Rainer Voss

By Catherine Austin Fitts

Sometimes it pays, like Switzerland, to keep your own currency.

Being the powerhouse in a major currency basket, like Germany, also has it’s advantages.

You want to make sure you watch our documentary pick for this week’s Let’s Go to the Movies, Der Banker: Master of the Universe. It’s a powerful interview with former German banker Rainer Voss.

Then take note of the last ten year equity ETF performance in Europe:

Switzerland (EWL) +97.3%

Germany (EWG) + 70.5%

France (EWQ) + 12.4%

Spain (EWP) +3.6%

Greece (GREK) – 10.5%

Portugal (PGAL) – 27.4%

Italy (EWI) -39.9%

2 Comments

Comments are closed.

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.

2 Comments

-

Hello Catherine or others, This may not be the right segment to ask this question in but I will ask it anyway.

Are monies held in a brokerage money market fund secure from their bank not being able to use it to pay off there own bank derivatives and creditors? I have heard that banks may be able to seize monies held in bank accounts, but no one talks about whether

monies held in Money Market funds are can be used to pay of debts should there be a meltdown. Thank you for considering this question.-

Elinor:

Planning on addressing tonight in short form,

Catherine

-

Comments are closed.

Hello Catherine or others, This may not be the right segment to ask this question in but I will ask it anyway.

Are monies held in a brokerage money market fund secure from their bank not being able to use it to pay off there own bank derivatives and creditors? I have heard that banks may be able to seize monies held in bank accounts, but no one talks about whether

monies held in Money Market funds are can be used to pay of debts should there be a meltdown. Thank you for considering this question.

Elinor:

Planning on addressing tonight in short form,

Catherine