To: The Wall Street Journal

Re: “The Fed Didn’t Cause the Housing Bubble”

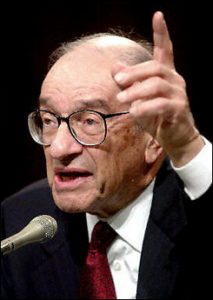

By: Alan Greenspan, former Chairman of the Federal Reserve

Dated: Wednesday, March 11, 2009

Ladies and Gentlemen:

In his article on your opinion page, “The Fed Didn’t Cause the Housing Bubble,” Alan Greenspan attributes the housing bubble to lower interest rates between 2002 and 2005. That’s amazing to me.

My company served as lead financial advisor to the Federal Housing Administration between 1994 and 1997. I watched both the Administration and the Federal Reserve aggressively implement the policies that engineered the housing bubble. These are described at my website and in my on-line book,Dillon Read & the Aristocracy of Stock Profits (http://www.dunwalke.com).

One story, for example, is the following:

“In 1995, a senior Clinton Administration official shared with me the Administration’s targets for Fannie Mae and Freddie Mac mortgage volumes in low- and moderate-income communities. We had recently reviewed the Administration’s plans to increase government mortgage guarantees — most of these mortgages would also be pooled and sold as securities to investors. Even in 1995, I could see that these plans would create unserviceable debt loads in communities struggling with the falling incomes expected from globalization. Homeowners would default on mortgages while losses on mortgage-backed securities would drain retirement savings from 401(k)s and pension plans. Taxpayers would ultimately be hit with a large bill . . . but insiders would make a bundle. I looked at the official and said that the Administration was planning on issuing more mortgages than there were houses or residents. “Shut up, this is none of your business,” the official snapped back.”

From: “Sub-Prime Mortgage Woes Are No Accident” /sub-prime-mortgage-woes-are-no-accident/)

One of the dirty little secrets behind the housing bubble is the long standing partnership of narcotics trafficking and mortgage fraud and the use of the two in combination to target and destroy minority and poor communities with highly profitable economic warfare. This model is global. It is operating in counties throughout the world as well as in US communities.

Of all the actions that the Federal Reserve took to engineer this housing bubble, the one that I would note is Mr. Greenspan’s efforts to pacify Congresswoman Waters regarding allegations of government sponsored narcotics trafficking at a time when open Congressional hearings would have contributed to an important discussion of the operations engaging in mortgage fraud in minority communities. See, “Financial Coup d’Etat,” Chapter 16, Dillon Read & the Aristocracy of Stock Profits which was written in 2005 and published in April 2006, drawing from an article I first published in May 1999.

“On December 18, 1997, the CIA Inspector General delivered Volume I of their report to the Senate Select Committee on Intelligence regarding charges that the CIA was complicit in narcotics trafficking in South Central Los Angeles. Washington, D.C. ’s response was compatible with attracting the continued flow of an estimated $500 billion–$1 trillion a year of money laundering into the U.S. financial system. Federal Reserve Chairman Alan Greenspan in January 1998 visited Los Angeles with Congresswoman Maxine Waters — who had been a vocal critic of the government’s involvement in narcotics trafficking — with news reports that he had pledged billions to come to her district. In February Al Gore announced that Water’s district in Los Angeles had been awarded Empowerment Zone status by HUD (under Secretary Cuomo’s leadership) and made eligible for $300 million in federal grants and tax benefits.”

Alan Greenspan is a liar. The Federal Reserve and its long standing partner, the US Treasury, engineered the housing bubble, including the fraudulent inducement of America as part of a financial coup d’etat. Our bankruptcy was not an accident. It was engineered at the highest levels.

Your publication of Greenspan’s breezy and bogus history of the housing bubble insults your readership.

Best Regards,

Catherine Austin Fitts

Assistant Secretary of Housing – Federal Housing Commissioner, Bush I

Great Documentation to learn from

http://wallstreetwatch.org/soldoutreport.htm

Actually, Jack, it is true. I spent years reading and research Gary Webb’s Dark Alliance and reviewing the CIA reports and testimony. And more.

Perhaps you would like to explain to us how a half a trillion military and intelligence establishment is helpless up against all those African-American teenagers? Or why the NY Fed/Fed wires and clearing systems that aggregate and control all wire transfers and clearance are helpless to notice $500 billion – $1 trillion plus of annual money laundering.

The reality is that no one needs to waste time running in circles on evidence games related to one particular narcotics trafficking operation. The truth is so obvious and the corruption so blatant that we can just use our common sense.

Who is running the high margin, profitable businesses? The people with the money or the poor people?

As someone once said to me, “I know how organized crime works. I dealt with the mafia when I was growing up. All I need to know when I watch the Harvard Endowment operate, is that I am watching the mafia model. Once I get over that I was the patsy and really did not know that the system was not legitimate, it is relatively easy to understand my world.”

Wall Street is full of ****, so is Washington, and no offense intended, Jack, so are you.

Name one country beside Israel which practices legalized apartheid, ethnic cleansing and now with a foreign minister who openly advocates it, laughs at all UN Resolutions and Human Rights Laws,commits continual acts of violence and massacres, and yet enjoys the full support of all Western leaders. If this is not from the power of organized Jewry around the world, what is it from? Why does the US and Europe act against their own interests in making enemies out of 300 million Arabs and over one billion Muslims, for this tiny little country that has the strongest army in the region including hundreds of nuclear warheads but claims the right of self-defense for itself but not others? Not one of Obama’s “bought and sold” gang or the “bought and sold” gang called Congress stood up to speak against the character assassination of Chas Freeman! Anyone who says Bush and the other puppets are not Jewish is fooled by who or what is really operating behind the scenes. When your country is run by the influence of people whose loyalty belongs to another country then it is not racist but patriotic to stand up for its defense.

One more thing…I believe Mr. Linton is wrong about the biggest property owners in Manhattan. They happen to be 2 Jews, Jerry Speyer and Robert Tishman, who own the Rockefeller Center, the Chrysler Building and other skyscrapers.

“Gawker’s publisher estimates that at least 19 of the Forbes 400’s 25 NYC billionaires are Jewish”.

Frankly, I do not care if all the Jews were billionaires, as long as they do not use their money to corrupt the system and the media.

When will our leaders care enough about the individuals, the people, to stop throwing money at the problem makers? The more bail out money diverted from the people, the greater the whole that is dug. The markets, supported by increasingly sized bailouts, only temporarily are buoyed as the underpinnings of debt upon debt provide new manipulations for scalping profits. A true economy is built upon the talents, abilities and stable business climates given to the individuals of a nation. Regularly dismantling our industries of yesteryear, our Mom & Pop enterprises, and the trades prized by generations of our own home grown peoples has riddled the infrastructure. Export the jobs and eventually there are fewer financially able to underpin the real economy. One might even think this obvious decade assault against the people of various developed nations is intentional.

“The reality is that no one needs to waste time running in circles on evidence games related to one particularly narcotics trafficking operation. The truth is so obvious and the corruption so blatant that we can just use our common sense.”

Dead on correct. Thanks, Catherine!

Proteus–

Wake up man and maybe try reading a book or two. China loses much in the current crisis due to the fact that their economy depends on exports to the West, not to mention their immense amounts of dollar reserves that they don’t want to see vanish with hyperinflation or a drop in the demand for the dollar. do your homework.