Money & Markets Report: May 15, 2025

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

Your cart is currently empty!

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

Money & Markets

Slogging through Patsy Capitalism

In this episode of Money & Markets, Catherine and John Titus discuss the prevailing economic uncertainty and its impacts on business planning. Against a backdrop of erratic government policies, businesses are struggling to navigate the fluid economic landscape marked by fluctuating tariffs and unreliable information.

Beyond the economic ramifications of these uncertainties, the conversation highlights broader issues of trust in governance. Stories on the role of AI in government operations, Palantir’s operational practices, and the financial and ethical controversies surrounding OpenAI underscore the complexities of the current system.

Catherine and John also touch on U.S.-China financial dynamics, evolving geopolitics in Russia and Ukraine, and the misuse of data by federal agencies. Additional topics of discussion include the climate change narrative, the Israeli-Palestinian conflict, Pope Leo the 14th’s unexpected rise (and financial implications for the Vatican), and private equity’s involvement in the health care sector.

Overall, the discussion paints a picture of a precarious economic environment influenced by political, technological, and financial factors.

Log in or subscribe to the Solari Report to enjoy full access to exclusive articles and features.

Already a subscriber?

- Weekly interviews, including the popular Money & Markets show

- Quarterly deep dives into major trends affecting you day-to-day

- Aggregation of the most relevant news stories

- Subscriber-only events and a digital platform to connect with other subscribers

- Weekly subscriber Q&A sessions with Catherine and the Solari team

34 Comments

Comments are closed.

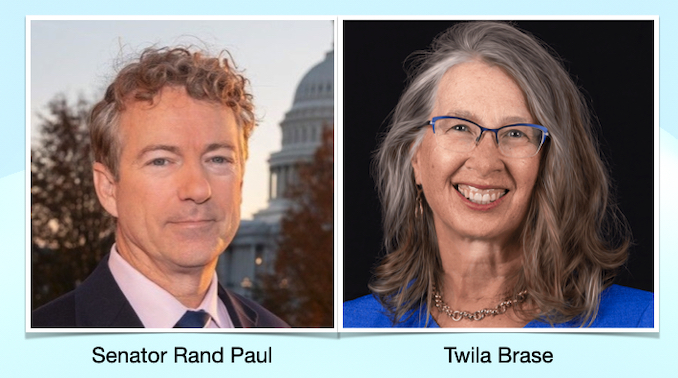

MAHA: Fighting The Biomedical War On The American Public

Authored by James Howard Kunstler

https://www.zerohedge.com/political/maha-fighting-biomedical-war-american-public

Louisiana governor pushes Trump to weigh primary challenger to GOP Sen. Bill Cassidy, AP sources say

https://apnews.com/article/louisiana-senate-cassidy-letlow-landry-trump-2026-632a2c454f82918ca84f94259129930d

The scuttlebutt is she is worse than Cassidy as a big Pharma stooge But has no significant track record so she will slide in unobtrusively as a major asset. Cassidy and this “Foghorn Leghorn”, corn pone and mealy mouthed Kennedy are as corrupt as they come. Big Pharma tactics dictate when someone is seen as noticeably controlled to the average person there is a need for change. When you see the impeachment vote issue, while true, as the main issue you should be very careful. He opposed RFK, Jr? Big deal. He did his backroom job on Jr. basically killing the Big Pharma opposition that Jr. wanted to work with. He does Susie Wiles’, THE REAL BOSS, bidding and so would this woman that could primary him. That is why we have 2 Big Pharma plants in these Means characters. Trump is loyal to Susie so he will do what she says. 2 of the main flaws in Trump are hubris and steadfast loyalty to those despite what many see as backstabbing his agenda.

https://nypost.com/2025/05/12/opinion/no-pres-trump-qatars-palace-in-the-sky-jet-isnt-a-free-gift-and-you-shouldnt-accept-it-as-one/

I know Catherine and John will cover this this week.

This was on the runner up list. Lots going on!

hi Catherine

Mick from Sydney Australia here long time follower of yourself and John. just signed up and

wanted to tell u how much I appreciate the time, energy, commitment and real reason u guys do what u do. you are contributing enormously to the understanding of were we are and were we should be going but who is standing in our way. thank you very much.

mick

Mick:

Welcome. Thank you for your kind words. I must say we have a great team here and we are very grateful to work for the Solari subscribers. We spend a lot of time outside of our comfort zone because the world is moving so fast, but it is good to be free to focus on what is real and who is truthful. Give my love to the Lucky Country – have not been back since the Pandemic.

https://thefederalist.com/2025/05/13/donald-trump-just-made-it-harder-to-go-to-federal-prison/

“The first subtext of this executive order is federalism: moving ordinary criminal prosecution back to the states, after decades in which the list of federal crimes has grown so sharply that no one can possibly know them all. The second subtext is about constitutional order: passing what has amounted to lawmaking from the administrative state back to Congress.

The third piece of subtext is demystification, and the order also requires every federal agency to compile, keep current, and make public a list of regulations that carry criminal penalties for violations.”

I understand the Vatican is in serious financial trouble. All the cardinals were informed of this at the very beginning of the event. Pope Francis tried for 12 years to fix the finances but was unable to. One of the people closest to the Pope did everything he could to stop the auditor who was hired to clean up the finances, including a suspicious breaking into the auditor’s computer in his office, stopping the inventory of buildings and financial assets. And finally telling the outside auditor the Pope no longer had faith in him. I read all this in the WSJ. I cannot remember the name of the cardinal involved in this. If I was told the finances are in very serious trouble, I would vote this cardinal in if he was very sincere of his faith in Christ as he has a degree in mathmatics. That is probably why he was voted in. If he is not, I leave it to God to change his heart for the better!

Can you imagine what would happen if the Vatican would declare bankruptcy? I can’t even imagine the implications.

My dinner companion the other night indicated a 1 billion deficit. I assumed he was referring to an annual operating deficit. No idea if that is true.

Thank you for the thoughtful discussion as always.

On the topics of US firms access China financial markets and relative cost of capital between US and China. Cost of capital is but one of a number of factors to compare in a market with local practices that differ considerably from the US. Businesses in China, especially those on the approved industrial policy pathway, have had for many years, access to very patient and abundant capital on very favorable terms as compared with US businesses.

A couple of questions that follow. First, if US financial institutions are constrained to play by US rules and norms, how will they fare even if given access to the Chinese market in a trade deal? Second, while a shift in relative cost of capital might further disadvantage US firms, do some other, less obvious, factors also need to be addressed to foster success on the economic front of unrestricted war versus China?