The Nasdaq - 3 Years Later

Become a member: Subscribe

- Money & Markets

- Weekly Solari Reports

- Cognitive Liberty

- Young Builders

- Ask Catherine

- News Trends & Stories

- Equity Overview

- War For Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Building Weatlh

- Via Europa

Solari’s Building Wealth materials are organized to inspire and support your personal strategic and financial planning.

Missing Money

Articles and video discussions of the $21 Trillion dollars missing from the U.S. government

No posts

- LATEST

- TOP SECTIONS

- SERIES

- Money & Markets

- Weekly Solari Reports

- Ask Catherine

- News Trends & Stories

- Equity Overview

- Cognitive Liberty

- Young Builders

- Building Wealth

- The War for Bankocracy

- Digital Money, Digital Control

- State Leader Briefings

- Food

- Food for the Soul

- Future Science

- Health

- Metanoia

- Solutions

- Spiritual Science

- Wellness

- Via Europa

- BLOGS

- RESOURCES

- COMMUNITY

- My Account

- Log In

- Subscribe

- Search

- Shop

- Support

- Donate

- Log Out

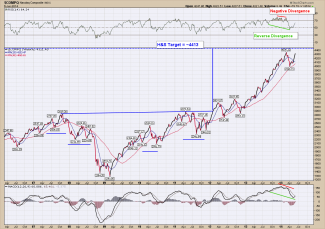

The Nasdaq – 3 Years Later

By Chuck Gibson

Many wonder why market technicians spend so much time analyzing the charts. The main reason is a skilled analyst can find opportunities, warnings and most importantly expectations of the future buried in price movement. Over the next couple of weeks blog posts I am going to not only go dust off some old charts I created a few years back (when I first started work on my CMT designation) and see how they are playing out but also introduce a few new ones.

This week let’s start off with an old chart I created at the start of 2012 and have presented every year since then of the U.S Nasdaq market. At the start of 2012, based on the prevalent bullish pattern that developed after the 2011 (-20%) pullback, the price objective of that pattern pointed at 4413. At the time the Nasdaq was about 2900 as you can see. I didn’t want to believe it. After analyzing and reanalyzing because of my disbelief, I thought to myself there had to be something wrong with the chart. If not the chart, it had to be me. I had to be either drawing or interpreting it incorrectly. There was no way it was going to go up an additional 50% from there. Jump forward almost 3 years and we can see the high created earlier in March of this year topped out at 4336. That is less than 2% away from the pattern target. If you are like me, you are wondering if now that it hit its target is that the end of the run or do we need more time to see if it can push higher?

Our mission is to help you live a free and inspired life. This includes building wealth in ways that build real wealth in the wider economy. We believe that personal and family wealth is a critical ingredient of both individual freedom and community, health and well-being.

Nothing on The Solari Report should be taken as individual investment, legal, or medical advice. Anyone seeking investment, legal, medical, or other professional advice for his or her personal situation is advised to seek out a qualified advisor or advisors and provide as much information as possible to the advisor in order that such advisor can take into account all relevant circumstances, objectives, and risks before rendering an opinion as to the appropriate strategy.

Be the first to know about new articles, series and events.