“The Dow Jones Industrial Average DJIA, +0.74% gained 211.81 points, or 0.7%, to close at 28,956.90, while the S&P 500 index SPX, +0.67% rose 21.65 points, or 0.7%, to 3,274.70. The Nasdaq Composite Index SPX, +0.67% added 74.18 points to finish at 9,203.43, a gain of 0.8%. All three benchmarks set new intraday and closing highs, with the Dow nearing the psychologically important 29,000 threshold.” ~ Marketwatch, January 9, 2020

By Catherine Austin Fitts

This week is the 2019 Annual Wrap Up Equity Overview with the quarterly blockbuster from Rambus Chartology. Check out the web presentation here for the quarterly financial charts and Rambus Chartology when posted on Thursday.

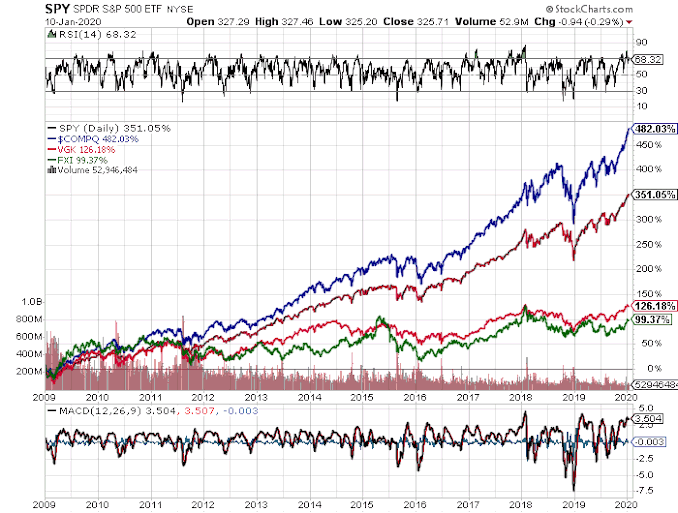

The U.S. equity market continues to outperform global equity markets. Here is a comparison of the NASDAQ and S&P with European and Chinese equity ETFs since 2009.

The Trump administration considers the U.S. stock market an essential performance indicator. The administration’s target appears to be a Dow above 30,000. Given the monetary and fiscal largesse underway in the Trump administration and the fact that it is a U.S. presidential election year, politics argues for rising corporate profits and a continued climb in the equity markets.

That said, the storm clouds are gathering across the globe as the failure of the unipolar model and the transition to a multipolar model raise profound questions regarding the preservation and performance of current global financial market trends—whether for currencies, stocks, or bonds. Do financial markets still offer opportunities to retail investors? Or have they become simply a way to channel monetary inflation into ever larger bubbles that are causing devastating non-economic allocations of capital? Are sovereign bond markets being squeezed dry to return us to an East and West Indies model—when corporations ruled the world and fielded mercenary armies? Or is a fundmental shift underway between global liquidity from West to East?

We will also look at how the “climate change op” fits in—and whether a new raid on the G7 pension funds is underway.

If you have not listened to my review of trends, top stories, and unanswered questions with Dr. Farrell in our first two parts of this 2019 Annual Wrap Up, I strongly recommend them to you as important background for the discussion this week regarding what is happening in the financial markets. You can access Part I here and Part II here.

In Let’s Go to the Movies this week, I will review Official Secrets—a movie about British intelligence specialist Katharine Gun who leaked a memo from the NSA that requested Britain’s help in collecting compromising information on U.N. Security Council members to blackmail them into voting in favor of an invasion of Iraq. The invasion of Iraq has left a lasting legacy of governments that cried wolf and then doubled down on secrecy. Official Secrets delivers great acting, excellent entertainment, and powerful insights into Deep State Tactics.

Please e-mail your questions for Ask Catherine or post them at the Money & Markets commentary here.

Talk to you Thursday!

Related Reading:

Last Year of Equity Overviews:

3rd Quarter 2019 Wrap Up – Equity Overview & Rambus Chartology

2nd Quarter 2019 Wrap Up – Equity Overview & Rambus Chartology

1st Quarter 2019 Wrap Up – Equity Overview & Rambus Chartology

2018 Annual Wrap Up – Equity Overview & Rambus Chartology

Catherine, What is your take on student loans? Should they be handled first and foremost?

Aaron:

Don’t understand. Do you mean should a person pay their student loan? Do you mean should Congress reform student loans?

Catherine

Should a person pay off their student loans first? Or Try to get some yield/invest it while retaining the ammount needed to pay it off

I am just worried about:

1) Opportunity Loss

2) Debt-Jubilee right after paying them off.

https://finance.yahoo.com/news/elizabeth-warren-says-she-will-cancel-42-million-borrowers-student-debt-on-day-one-154007044.html

To give you a recommendation, a person would need to know significant amount about you and your work and financial profile. Anyone who gives a recommendation without that information should not be listened to IMO.

Here are some rules of thumb:

1. Now is a good time to get out of debt, with the possible exception of low interest rate mortgage debt.

2. Generally, better to reduce high interest rate debt first. Exception, absence of trustworthiness of the lender servicer means you may want to focus on getting the untrustworthy out of your life first.

3. Ignore promises from Washington. What a politician says they are going to do and what will happen are two different things. Saw lots of time lost and heartbreak over mortgage relief promised and not delivered. If you want to hold on for possible DC debt relief, assume it is a long shot and keep ensuring that your savings is significant.

Meantime Warren has a very, very low chance of winning. Right now, Sanders is the only one who has a chance of winning, and it could still end up in a brokered deal at the convention.

4. If you do not pay off debt and invest the money is assets, make sure whatever leverage you use on the assets is something you can carry in the worst case, so you can not be pumped and dumped.

5. Make sure the after-tax returns of the investments you are making is significantly better than what you are paying on the debt.

Bottom line. You are in a war. Manage your affairs so you can not be cornered.

Thanks You Catherine,

That was very helpful.